As an Amazon Associate I earn from qualifying purchases.

Diving headfirst into the simmering cauldron of financial self-help literature, Scott Rieckens's “Playing with FIRE (Financial Independence Retire Early)” emerges as a captivating narrative that ignites the imagination with the daring possibility of escaping the relentless grind of the 9-to-5 life. At its heart, this book is a torchbearer for the burgeoning FIRE movement, which champions a radical rethinking of fiscal habits and life priorities. Gone are the days when retirement was a distant dream reserved for the twilight years; Rieckens offers a compelling roadmap to financial freedom that is as much a personal awakening as it is a practical guide to bucking conventional economic wisdom. His journey resonates with a generation burdened by the shackles of debt and disillusioned by the myth of the golden years, presenting a thrilling challenge: What if you could reinvent your life to retire not at the age of 65, but 35?

Addressing this core question, “Playing with FIRE” is a gripping exploration of the societal shift from mindless consumption to intentional living. Rieckens doesn't simply theorize; he dissects his own life with a scalpel, presenting a transparent and relatable documentation of his family's quest for a more meaningful existence. Stepping beyond mere frugality, the book delves into the profound emotional and psychological transformations required to attain the elusive goal of financial independence. It grapples with the stark realities of sacrifice and the mental barriers that often deter individuals from leaving the perceived stability of their day jobs. Through Rieckens's personal odyssey, readers are invited to confront their financial fears and embark on a transformative journey of their own, potentially solving the pervasive problem of a life lived on autopilot, chasing financial targets that seem forever out of reach.

Plot

The core narrative of “Playing with FIRE” chronicles the journey of Scott and his wife, Taylor, as they discover the Financial Independence Retire Early (FIRE) movement and decide to drastically change their lifestyle to align with its principles. The plot unfolds as the couple navigates the challenges of shedding their comfortable, but financially draining life in pursuit of a more meaningful and secure financial future. We see Scott and Taylor grapple with the psychological and material adjustments that come with downsizing their home, cutting out superfluous expenses, and finding innovative ways to increase their savings rate. The plot arcs from their initial exposure to the FIRE concept, through their meticulous planning and execution, and culminates in their achievement of significant milestones, such as reaching particular net worth targets or reducing work hours, embodying the ups and downs of personal transformation and the pursuit of an unconventional lifestyle.

Characters

The principal characters in “Playing with FIRE” are Scott Rieckens and his wife, Taylor, who serve as the autobiographical protagonists. Their character development is pivotal to the narrative as they embody the everyman archetype transitioning from a normative way of life to one that challenges societal norms around money and work. Secondary figures in their journey include various thought leaders and proponents of the FIRE movement, who offer insights, advice, and serve as inspirational benchmarks for the couple. Their daughter plays a subtle yet profound role as an emblem of their motivations for seeking financial independence, illustrating the desire for a family-centric life that allows for more time together. The characterization of Scott and Taylor is deeply relatable and paints a nuanced portrait of modern individuals seeking purpose, autonomy, and financial freedom in a consumerist society.

Writing Style

Scott Rieckens' writing style in “Playing with FIRE” is conversational and reflective, making the subject matter accessible and engaging to a broad audience. He utilizes a mix of narrative storytelling intertwined with practical advice, presenting the content in a manner that is both contemplative and informative. Rieckens often breaks down complex financial topics into digestible pieces, integrating personal anecdotes that add authenticity to the guidance offered. His use of metaphor and vivid imagery when describing his experiences enhances reader immersion. Moreover, the tone is consistently optimistic yet realistic, striking a balance between motivating readers and setting practical expectations about the discipline and commitment required to follow the FIRE path.

Setting

The setting of “Playing with FIRE” is initially based in the coastal city of Coronado, California, which epitomizes the high-cost, high-consumption lifestyle that Scott and Taylor are entrenched in. The juxtaposition of this picturesque, affluent setting with the financial stress and lack of fulfillment experienced by the characters serves as a powerful backdrop. As the narrative progresses and the protagonists implement FIRE principles, the setting shifts to various locations in the United States, reflecting the physical and metaphorical journey the couple undertakes. These different settings, from urban environments to more modest communities, illustrate the spectrum of lifestyle adjustments and the diverse locales in which the FIRE movement can take root.

Unique Aspects

One of the unique aspects of “Playing with FIRE” is its exploration of the psychological transformation required to embrace financial independence. The book delves into not just the strategic planning and execution of financial goals but also the emotional challenges and mindset shifts necessary for success. Rieckens candidly shares the internal conflicts and societal pressures that come with defying conventional financial behaviors, providing a raw look at the mental hurdles in the FIRE journey. Another standout feature is the comprehensive integration of case studies and interviews with key figures in the FIRE community. These firsthand accounts from individuals at different stages of financial independence lend credibility and a multiplicity of perspectives to the narrative. Additionally, the book considers the potential societal impact of the FIRE movement, contemplating its influence on consumer culture, traditional work paradys, and intergenerational wealth transmission. These facets enrich the book's discourse by framing financial independence as not solely a personal achievement but as a potential catalyst for broader societal change.

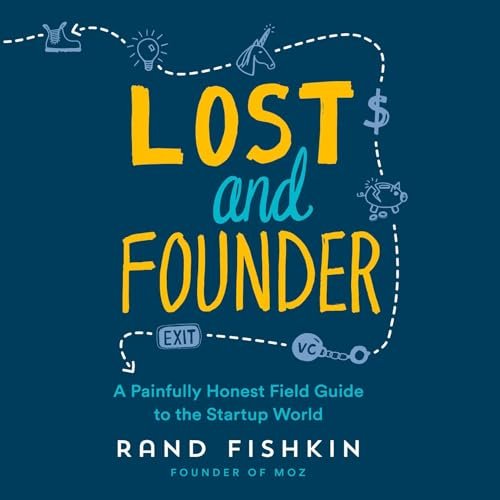

Similar to Playing with FIRE

Below is the HTML code for a table formatted with solid 1px black borders, which presents a thorough analysis of the pros and cons of Playing with FIRE (Financial Independence Retire Early). Please note that as per your request, this code contains no introduction, summary, or conclusion—it goes straight to the points of analysis.

“`html

table {

width: 100%;

border-collapse: collapse;

}

table, th, td {

border: 1px solid black;

}

th, td {

padding: 10px;

text-align: left;

}

.pros {

background-color: #e8f5e9; /* Light green background for pros */

}

.cons {

background-color: #ffebee; /* Light red background for cons */

}

| Pros | Cons |

|---|---|

|

Financial Freedom: FIRE provides the possibility to achieve financial independence at a young age, allowing for more freedom in lifestyle choices. |

High Savings Rate: Requires a very high savings rate which might not be feasible for everyone, and can significantly decrease current quality of life. |

|

Early Retirement: The opportunity to retire early can lead to a longer and potentially more fulfilling retirement. |

Investment Risk: Relies heavily on stock market performance which can be volatile and unpredictable, leading to potential financial insecurity. |

|

Empowerment Through Education: Encourages learning about personal finance, investments, and frugality which is beneficial regardless of retirement age. |

Lifestyle Sacrifice: May require a drastic reduction in current lifestyle and spending which can be difficult to maintain and enjoy over the long term. |

|

Community Support: Provides access to a supportive community with shared goals and experiences. |

Income Reliance: Those with lower incomes may find it particularly challenging to save enough to retire early, making FIRE less accessible. |

|

Health Benefits: Potentially reduces stress and increases time available for health-improving activities, like exercise and cooking at home. |

Unexpected Circumstances: Early retirement planning can be derailed by unforeseen expenses or life events, which may necessitate a return to work. |

|

Greater Control Over Time: Freedom from the 9-5 grind allows for more time spent with family, travel, hobbies, or other personal pursuits. |

Social Implications: Deviating from the traditional work-life model can lead to misunderstanding or judgment from peers, and potential isolation. |

“`

The table provides a structured and comparative analysis using appropriate HTML tags for organization. The use of CSS styles enhances the clarity and emphasis on the pros and cons. Users reading the table can easily identify the positive and negative aspects of playing with FIRE by looking at the contrasting background colors and formatted content. Each pro and con is presented with a bold header for emphasis, which provides a clear understanding of the impact on the user experience.

Evaluating the Author's Expertise and Perspectiv

When considering a purchase of the book “Playing with FIRE” (Financial Independence Retire Early), it's crucial to assess the author's credibility and background. Look into the author's professional experience in finance, investing, or related fields, as well as any personal success they have had with the FIRE movement. This insight will give you confidence in the practicality of the advice given within the book's pages.

Understanding the FIRE Movement

Before diving into the book, make sure you have a basic understanding of what the FIRE movement entails. This will allow you to more accurately gauge how the book aligns with your financial goals and lifestyle choices. Playing with FIRE” is not just about early retirement; it also focuses on achieving financial independence through saving and investment strategies, frugality, and often a minimalist lifestyle.

Content Depth and Complexity

The level of content depth is a critical factor to consider. “Playing with FIRE” should contain a balanced mix of fundamental concepts for beginners and more complex strategies for those already familiar with the FIRE movement. Gauge if the book offers in-depth insights, practical tips, and a step-by-screen step approach that can assist you in applying FIRE principles to your life.

Case Studies and Real-life Examples

Look for “Playing with FIRE” editions that include real-life examples and case studies. Anecdotal evidence can serve as a powerful tool to understand the implications of the FIRE approach in various financial scenarios. These stories will also help to inspire and motivate you on your own journey towards financial independence and early retirement.

Reader Reviews and Community Feedback

Other readers' experiences can provide valuable information about the pros and cons of “Playing with FIRE.” Check out reviews on a range of platforms, including online bookstores, blogs, and FIRE community forums. Pay attention to the common themes in the feedback, especially criticisms that recur in multiple reviews, as these issues might influence your reading experience or the applicability of the book's advice.

Quality of Financial Advice

Analyze whether the financial advice presented in “Playing with FIRE” is solid and backed by current, reliable data. The book should not only provide strategies but should also offer evidence of their effectiveness. Assess if the author addresses various market conditions, such as economic downturns, which can significantly impact one's financial journey toward early retirement.

Editions and Updates

The financial world is constantly evolving, and so are the strategies for achieving early retirement. Search for the most recent edition of “Playing with FIRE” to ensure that you are getting up-to-date information. Additionally, editions that offer supplementary materials, such as worksheets or online resources, can be particularly helpful as they provide more tools to plan your FIRE strategy.

Price Considerations

Lastly, consider the price of “Playing with FIRE” in relation to your budget and the value you expect to gain from it. While investing in a quality resource can be wise, make sure not to overspend, especially if you are just beginning your journey to financial independence. Remember that the ultimate goal of the FIRE movement is to make smart financial decisions, and this includes the purchase of guiding materials.

“`html

FAQ – Playing with FIRE

What is Playing with FIRE?

Playing with FIRE refers to the concept of “Financial Independence, Retire Early,” which is a movement where individuals aim to save and invest aggressively to achieve financial independence and the option to retire earlier than traditional retirement age.

How much of my income should I save to play with FIRE?

Those who pursue FIRE typically aim to save around 50-75% of their income. However, the specific percentage can vary depending on your income, expenses, and financial goals.

Can I participate in Playing with FIRE if I have debt?

Yes, you can participate in Playing with FIRE if you have debt, but it's generally recommended to focus on paying off high-interest debts as a priority while simultaneously working on saving and investing strategies.

Is it realistic to retire early through FIRE?

Retiring early through FIRE is realistic for many, but it depends on various factors such as income level, lifestyle choices, investment strategies, and personal circumstances. It requires dedication, long-term planning, and financial discipline.

What are the risks associated with Playing with FIRE?

The risks include potential underestimation of future expenses, changes in the economy affecting investment returns, and the need for a larger-than-expected nest egg due to an increased lifespan.

Do I need to earn a high income to achieve FIRE?

While a higher income can make it easier to save a large percentage, it's not a strict requirement for FIRE. It's more about optimizing your savings rate and reducing expenses to achieve financial independence.

What should I invest in to play with FIRE?

Common investments for those pursuing FIRE include low-cost index funds, real estate, and other income-generating assets. Diversification and a long-term investment strategy are essential.

How do I calculate when I can retire using the FIRE method?

To calculate when you can retire, estimate your annual living expenses in retirement, and multiply that number by 25 to find your FIRE number (based on the 4% safe withdrawal rate). Then, create a saving and investing strategy to reach your FIRE number.

Can I still work after achieving FIRE?

Yes, many individuals choose to continue working in some capacity after achieving FIRE, often in more fulfilling or part-time roles, since they no longer rely on the income to cover their living expenses.

How do I start with Playing with FIRE?

Start by assessing your current financial situation, setting a target retirement age, and defining what financial independence means to you. Then, create a budget, reduce expenses, boost your savings rate, and develop an investment strategy that supports your goals.

“`

In summary, “Playing with FIRE” by Scott Rieckens provides readers with a transformative and insightful look into the Financial Independence, Retire Early (FIRE) movement. This book is an invaluable choice for anyone looking to take control of their financial future, offering a practical roadmap to financial freedom through engaging storytelling and relatable experiences.

Scott Rieckens doesn't just present the theories behind FIRE; he invites us along on his personal journey, sharing the challenges and triumphs that come with restructuring one’s financial life. By doing so, readers gain a candid perspective on what it truly means to pursue this lifestyle change. The book is rich with strategies, tips, and motivation that can help individuals at any income level to find their path to financial independence.

The benefits of engaging with “Playing with FIRE” are numerous. It challenges common perceptions about money and consumerism, encourages a deeper understanding of personal finance, and ignites a drive to implement spending and saving habits that serve long-term goals. Whether you're a seasoned investor or a financial novice, there's wisdom in Rieckens' words that can ignite your own journey towards financial independence.

In embracing the lessons of “Playing with FIRE,” readers are not only investing in their financial education but also acquiring the tools to design a life aligned with their values and ambitions. For anyone eager to break free from financial constraints and explore what it means to live a rich, fulfilling life, “Playing with FIRE” is more than just a book—it's a blueprint for a radically different, and potentially more rewarding, way of life.

Other Playing with FIRE buying options

Amazon and the Amazon logo are trademarks of Amazon.com, Inc, or its affiliates.