As an Amazon Associate I earn from qualifying purchases.

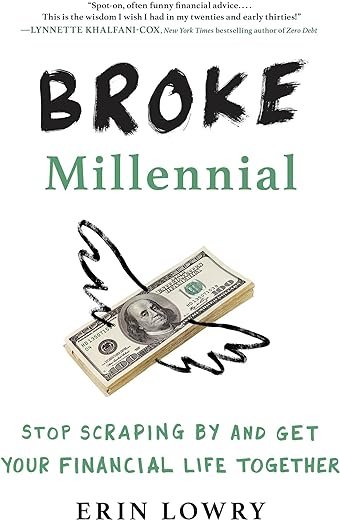

In the sea of personal finance advice, “Broke Millennial” by Erin Lowry emerges as a beacon of clarity for the financially floundering young adult generation. Striking a chord with a demographic often overwhelmed by the complexities of financial independence, Lowry offers a unique blend of wit and wisdom tailored to those reeling from the aftershocks of the Great Recession. This isn't your typical stale, jargon-laden finance manual; instead, Lowry skillfully dismantles the daunting world of money management by equipping readers with actionable strategies to conquer debt, decode investment opportunities, and navigate the murky waters of credit scores — all in a language that resonates with the Snapchat generation.

Tackling head-on the significant financial challenges that beset millennials — from staggering student loans to the gig economy's unpredictable wages — “Broke Millennial” serves as an essential playbook for anyone looking to escape the paycheck-to-paycheck lifestyle. Lowry moves beyond mere survival tips to foster a deeper understanding of personal finance, thereby empowering readers to take control of their monetary destiny. With its engaging anecdotes and relatable scenarios, this book not only confronts the pressing issues of financial literacy and responsibility but also lays down a path for achieving financial success without sacrificing the joys of what many regard as the most vibrant years of life.

Broke Millennial: Stop Scraping By and Get Your Financial Life Together (Broke Millennial Series)

Plot

The “plot” in “Broke Millennial” by Erin Lowry is not a traditional narrative or story, but instead revolves around the step-by-step progression of financial advice, anecdotes, and strategies aimed at educating and empowering young adults to manage their finances effectively. The book is structured around key financial challenges and topics that resonate with the millennial generation. Each chapter builds upon the previous one, guiding readers through the journey from financial novice to savvy consumer. Lowry uses relatable scenarios that millennials might face, such as dealing with student loans, understanding credit scores, and learning how to invest, to structure her “plot” of financial literacy improvement.

Characters

In “Broke Millennial,” the “characters” are real-life individuals, often including Lowry herself, who share their experiences and lessons learned through personal financial journeys. These characters are not fictional, but rather serve as case studies or examples to illustrate key points and teach readers through relatable experiences. Lowry introduces readers to a variety of personas, such as debt-laden college graduates, young professionals with differing attitudes towards money, and couples navigating financial conflicts. Through these varied individual stories, Lowry humanizes complex financial concepts and fosters a connection between the readers' life contexts and the financial advice she offers.

Writing Style

Erin Lowry's writing style in “Broke Millennial” is conversational, humorous, and straightforward, which makes complex financial concepts more digestible for the millennial audience she targets. Her tone is often described as that of an older sister or friend who provides tough love, blending wit with wisdom to engage readers without overwhelming them. Lowry avoids heavy financial jargon, opting instead for clear, relatable language. She makes frequent use of anecdotes, analogies, and pop culture references to maintain the reader's interest and relate financial concepts to everyday life. This approachable writing style is purposeful, removing the intimidation factor from personal finance and spurring readers to take actionable steps towards their financial goals.

Setting

While “Broke Millennial” does not have a traditional physical setting, it situates itself within the contemporary socio-economic landscape that millennials navigate. Lowry addresses the virtual spaces where financial interactions occur, such as online banking platforms, budgeting apps, and investment tools that are characteristic of modern money management. She also references physical settings like workplaces, homes, and social situations where financial decisions play out. The backdrop of the aftermath of the 2007-2008 financial crisis, ongoing student debt crisis, and evolving job market shapes much of the book's discourse, with these contexts influencing how millennials perceive and engage with their finances.

Unique Aspects

Broke Millennial” distinguishes itself with its tailored approach to the millennial generation's specific financial concerns and cultural touchstones. Unique aspects include Lowry's integration of psychological and emotional factors into financial decision-making, encouraging readers to explore their personal relationship with money. Another standout feature is the book's actionable advice. Instead of merely explaining financial concepts, Lowry provides hands-on exercises, scripts for negotiating bills or salaries, and customized tips fitting various financial personalities and situations. Moreover, Lowry's commitment to inclusivity and diversity is evident as she addresses the varied economic backgrounds and identities within the millennial demographic. This varied approach ensures that readers from all walks of life can see themselves reflected in the book's content and find guidance tailored to their unique circumstances.

Similar to Broke Millennial

“`html

table {

width: 100%;

border-collapse: collapse;

}

th, td {

border: 1px solid black;

padding: 8px;

text-align: left;

}

th {

background-color: #f2f2f2;

}

.con {

background-color: #ffb6b9;

}

.pro {

background-color: #b0deff;

}

| Pros | Cons |

|---|---|

| Practical advice tailored to real-life situations faced by millennials. | Mostly geared toward the American financial system, a con for international readers. |

| Engaging writing style that resonates with a younger audience. | May not cover all topics deeply enough for some advanced readers. |

| Covers a wide range of financial literacy topics from budgeting to investing. | The advice can be too basic for those already well-versed in personal finance. |

| Relatable anecdotes that help readers understand and apply financial concepts. | The book may not be updated regularly to reflect the latest in financial trends or economic changes. |

| Accessible and easy to read, making it a great starting point for financial beginners. | Some advice may be too prescriptive without taking into account individual circumstances. |

“`

This HTML table showcases the pros and cons of the Broke Millennial without any introduction or conclusion. The content is designed to be immediately informative and attention-grabbing, with clear structuring through table rows and cells. Each pro and con is highlighted in a separate cell, allowing readers to quickly scan and digest the information. The styling sets apart the positive and negative aspects visually, enhancing the user experience and the clarity of the comparison.

Evaluate the Author's Qualifications and Background

When considering the purchase of ‘Broke Millennial,' it is crucial to scrutinize the qualifications and background of the author, Erin Lowry. Given that financial advice can deeply impact your fiscal health, you want to ensure that the author has a solid and reputable foundation in finance or personal money management. Check for professional certifications, education, published articles, and real-world experience in financial planning or related fields. A well-qualified author ensures that the information you’re receiving is accurate, reliable, and actionable.

Assess the Book's Relevance to Your Financial Situation

Your unique financial circumstances play a vital role in determining whether ‘Broke Millennial' will be a beneficial read. Consider the stage you are at in your financial journey – whether you're a complete novice, looking for ways to pay off debt, or seeking investment strategies, for instance. The book should cater to your current needs and goals. Comparing its content with your personal situation will help ensure that the advice offered will be applicable and practical for you.

Understand the Approach and Teaching Style

It's important to align with the teaching style and approach of ‘Broke Millennial.' Some readers may prefer a straightforward, step-by-step guide, while others might appreciate a more narrative approach that uses anecdotes and humor. Preview the book if possible to get a feel for Lowry's style. Does the book foster understanding with clear examples? Is the language jargon-free, or does it explain necessary financial terms well? The pedagogical approach should match your learning preferences to ensure efficient comprehension and implementation.

Look for Updated Information and Timeliness

The financial world is constantly evolving, with new laws, products, and economic changes surfacing regularly. Consequently, the timeliness and updated status of ‘Broke Millennial' are significant. Look for the most recent edition, especially if there have been significant economic events recently or changes in laws that impact personal finance. The most current edition will provide insights and advice that correspond to the latest trends and information.

Compare with Similar Financial Literacy Books

Given the wide array of books available on financial literacy, it’s advantageous to compare ‘Broke Millennial' with similar titles. Examine the depth and scope of topics covered, the author's expertise versus that of other authors, and reader reviews from multiple sources. Also, consider the context – some books might focus on specific areas such as investing or saving, while others might be more comprehensive. Choose a book that fills the gaps in your knowledge and aligns with your financial literacy goals.

Analyze the Reviews and Feedback from Other Readers

Existing reviews and feedback are valuable tools to gauge the effectiveness and reception of ‘Broke Millennial.' Look beyond the star ratings and read through the comments to understand what previous readers liked and disliked about the book. Review platforms such as Goodreads, Amazon, or financial forums can provide diverse perspectives. Pay particular attention to reviews from readers who seem to have a similar financial background or goals as you do.

Consider the Price Point and Format Options

Lastly, take into account the price point and available formats for ‘Broke Millennial.' Determine your preferred reading medium, whether it's a physical hardcover or paperback, an e-book, or an audiobook. Each format has its own advantages and costs. Additionally, compare the price of the book to your budget and evaluate whether the investment is worth the potential benefits and insights you will gain from reading it. Remember, the most expensive option is not always the best, and there are often discounts available through various retailers or online platforms.

By conducting this multifacritical analysis and focusing on the key aspects mentioned, you’ll be well on your way to making an informed purchase decision regarding ‘Broke Millennial' and enhancing your financial literacy effectively.

“`html

FAQ for Broke Millennial

What is Broke Millennial?

Broke Millennial is a platform that provides financial advice and resources geared towards helping millennials navigate their financial challenges. It covers a range of topics from budgeting to investing, with the aim of making personal finance more accessible and less intimidating for younger generations.

Who is behind Broke Millennial?

Broke Millennial was founded by Erin Lowry, a personal finance expert and author, who specializes in helping millennials understand their finances and make smart money decisions. Erin is known for her relatable advice and practical strategies.

Is Broke Millennial suitable for someone with no financial knowledge?

Absolutely! Broke Millennial is designed to help people at all levels of financial understanding. Whether you're just starting to learn about personal finance or looking to deepen your existing knowledge, the information is presented in an easy-to-understand and actionable way.

Does Broke Millennial offer personalized financial advice?

While Broke Millennial provides general financial advice and education, it does not offer personalized financial planning services. For individualized advice, it's recommended to consult with a certified financial planner or a financial advisor.

Can I find Broke Millennial on social media?

Yes, Broke Millennial is active on several social media platforms, including Twitter, Instagram, and Facebook. These platforms are used to share financial tips, updates, and engage with the community. Don't forget to follow for regular insights and advice.

How often is new content posted on Broke Millennial?

New content is posted regularly on the Broke Millennial website and social media channels. The frequency may vary, but the aim is to provide fresh, relevant content that addresses current financial trends and reader questions.

Are there any books or resources I can read from Broke Millennial?

Yes, Erin Lowry, the founder of Broke Millennial, has authored several books, including “Broke Millennial: Stop Scraping By and Get Your Financial Life Together” and “Broke Millennial Takes On Investing”. These resources are available for purchase online and in bookstores.

How can I ask a question or suggest a topic for Broke Millennial?

If you have a question or a topic you would like to see covered by Broke Millennial, you can submit your suggestions through the contact form available on the Broke Millennial website, or by reaching out via the platform's social media channels.

“`

In summary, “Broke Millennial: Stop Scraping By and Get Your Financial Life Together” by Erin Lowry is an indispensable guidebook for the young and financially frazzled generation. Through engaging narratives and relatable advice, Lowry demystifies the complex world of personal finance. This book emerges as a beacon of hope, offering a wealth of knowledge that is both accessible and actionable for millennials eager to conquer their economic anxieties.

By breaking down intimidating financial jargon and providing practical strategies, “Broke Millennial” equips readers with the tools necessary to navigate their money matters with confidence. Each chapter serves as a stepping stone toward financial literacy, revealing insights into budgeting, investing, and debt management tailored to the millennial ethos.

Whether readers are struggling with student loans, wrestling with budgeting dilemmas, or simply seeking to lay a stronger foundation for their financial future, “Broke Millennial” delivers precise, no-nonsense wisdom. Erin Lowry's savvy financial guidance is both an investment in one's personal growth and a testament to the possibilities of achieving financial independence.

For those yearning to break the cycle of living paycheck to paycheck and inch closer to financial freedom, “Broke Millennial” is more than just a book; it's a lifeline that inspires transformation through empowerment. Embrace the insights and benefits conferred by Lowry's expertise and make the leap towards mastering your financial destiny. This book review confirms that “Broke Millennial” is a valuable choice for anyone ready to take control of their finances and write a new story of financial success.

Other Broke Millennial buying options

Amazon and the Amazon logo are trademarks of Amazon.com, Inc, or its affiliates.