As an Amazon Associate I earn from qualifying purchases.

In an era where economic uncertainty is prevalent, Grant Sabatier's “Financial Freedom: A Proven Path to All the Money You Will Ever Need” emerges as a beacon of hope, challenging the traditional 9-to-5 grind and the decades-long road to retirement. Sabatier, who catapulted from a mere $2.26 in his bank account to financial independence in five years, offers readers a blueprint to escape the paycheck-to-paycheck lifestyle. This book isn't just another personal finance guide; it's a manifesto for a generation seeking to redefine wealth and discover fulfillment well beyond the constraints of conventional money management.

“Financial Freedom” cuts through the noise of the saturated financial advice market by delivering actionable strategies that are both innovative and pragmatic. The book confronts the dire problems facing many today: stagnant wages, rising living costs, and the pervasive sense of never having enough. Through the lens of Sabatier's own journey and the wisdom garnered from interviews with millionaires, readers are equipped with the tools to achieve financial independence earlier than the traditional retirement age. The book's significance is amplified in a society where the allure of quick fixes and the pitfalls of consumerism perpetuate financial distress. Sabatier's philosophy offers not only a pathway to wealth but also the promise of reclaiming time—a commodity often traded for money but infinitely more valuable.

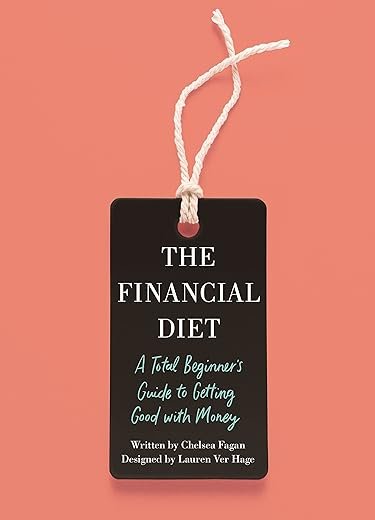

The Financial Diet: A Total Beginner's Guide to Getting Good with Money

Plot

Financial Freedom doesn't feature a plot in the conventional literary sense, as it is a non-fiction book focused on personal finance and wealth-building strategies. Instead, the book's structure follows a progression of practical steps designed to guide the reader from their current financial situation to achieving financial independence. Grant Sabatier presents a compendium of lessons, narratives, and action plans that constitute the ‘plot' of someone's financial transformation. Through the lens of his own story – from being nearly broke to becoming a millionaire in five years – Sabatier's plot unfolds as a series of financial milestones and mindset shifts that readers are encouraged to replicate.

Characters

As a personal finance guidebook, “Financial Freedom” does not feature characters in the fiction sense. However, the most prominent ‘character' can be considered Grant Sabatier himself, as he shares his experiences, strategies, and philosophies with the reader. Additionally, the book showcases anecdotal characters – composite profiles of individuals or case studies – who have either succeeded or failed in various financial endeavors. These characters serve to illustrate the range of financial behaviors and outcomes that can result from different actions, acting as cautionary tales or inspirational stories based on real-world examples.

Writing Style

Grant Sabatier's writing style in “Financial Freedom” is straightforward and prescriptive, aimed at making complex financial concepts accessible to the average reader. His voice is motivational, imbuing optimism and a can-do spirit throughout the book. Sabatier avoids jargon and opts for simplicity to ensure that the steps towards financial freedom are clear and actionable. He often employs metaphors and analogies to make financial principles more relatable, and the style is also reflective as he delves into personal experiences that underscore his points. Furthermore, the writing uses a mentor-like approach, often addressing the reader directly and imparting advice as if in a one-on-one consultation.

Setting

“Financial Freedom” is not confined to a specific geographical setting, as it addresses financial independence in a context that is applicable across different regions and economies. However, the financial landscapes and institutions referred to in the book are primarily based on the United States' economic system. The ‘setting' fluctuates between personal narratives set in real-world environments and theoretical scenarios that illustrate various financial principles. Sabatier also explores the ‘inner setting' of the reader's mindset, emphasizing how one's surroundings, habits, and beliefs can impact financial decision-making and the pursuit of wealth.

Unique aspects

One of the unique aspects of “Financial Freedom” is its multifaceted approach to achieving wealth, combining tactics from the realms of frugality, investment, entrepreneurship, and personal development. Unlike many personal finance books that focus on a single principle or strategy, Sabatier presents an all-encompassing roadmap, suggesting that anyone, regardless of their current financial position, can achieve freedom. He integrates mindfulness and life satisfaction as critical components of financial planning, challenging the traditional notion that accumulation of wealth is the sole indicator of success. Moreover, Sabatier's emphasis on leveraging modern technological tools and side hustles to expedite financial freedom offers a contemporary twist on the subject. He updates the concept of passive income streams through digital and online enterprises, reflecting the opportunities unique to the 21st-century economy. His book is also pioneering in how it defines ‘financial freedom' not just as a quantitative measure, but as a state of mental well-being and life balance.

Similar to Financial Freedom

Below is the HTML code to format and style the Pros and Cons of Financial Freedom:

“`html

table {

width: 100%;

border-collapse: collapse;

}

table, th, td {

border: 1px solid black;

}

th, td {

padding: 10px;

text-align: left;

}

.pros {

background-color: #e0ffe0;

}

.cons {

background-color: #ffe0e0;

}

Pros of Financial Freedom

| Advantage | Impact on User Experience |

|---|---|

| Stress Reduction | Having financial freedom significantly reduces stress related to finances, leading to a more relaxed and enjoyable life. |

| Increased Choices | Financial independence allows users the flexibility to choose how, where, and when they work, enhancing satisfaction and personal autonomy. |

| Early Retirement | With adequate funds, users can opt to retire earlier, giving them more time to pursue personal interests and hobbies. |

| Less Dependency | User reliance on a traditional job for income is reduced, offering a sense of security and self-reliance. |

Cons of Financial Freedom

| Disadvantage | Impact on User Experience |

|---|---|

| Financial Risk | Creating financial freedom often requires significant up-front investment which can impact users if not managed properly. |

| Users may experience stress from managing their own assets, which can involve complex decision making and constant monitoring. | |

| Increased Responsibility | Being financially independent means more responsibilities fall on the individual, which can be overwhelming or burdensome for some. |

| Social Pressure | Those who achieve financial freedom may face social pressures and expectations from family, friends, and society to maintain or support others financially. |

“`

This code utilizes HTML table tags to delineate the pros and cons of financial freedom. Each section, pros and cons, are highlighted with a different colored background for emphasis and each point's impact on user experience is explored under separate cells. This method ensures that there is no confusion between the advantages and the disadvantages, making the information easy to read and understand.

Evaluating Author Expertise and Background

One of the most critical factors in selecting a book on financial freedom is the credibility of the author. Potential buyers should look for authors who have proven success in personal finance and wealth-building. Research the author's professional background, education, and real-life experience in financial planning or investment. Books written by industry experts who have firsthand knowledge and success in achieving financial freedom are more likely to provide practical and actionable advice.

Comprehensiveness of Content

Financial freedom is a multi-faceted goal that involves budgeting, investing, saving, and strategizing. As such, a quality guide should cover a variety of topics to offer a holistic approach. Review the table of contents to ensure that the book provides a broad yet detailed roadmap covering all the pertinent subjects, including debt management, income diversification, investment strategies, and retirement planning. A comprehensive guide should address short-term financial goals as well as long-term planning.

Practicality and Applicability

While theory and motivation are important, a financial freedom book should primarily be practical and applicable to a wide range of financial situations. Look for guides that include case studies, actionable steps, worksheets, and templates that can be directly applied to your financial life. The best books offer insights that cater to various income levels and personal circumstances. Books that provide clear, step-by-step actions can greatly enhance the learning experience and facilitate real-world application.

Educational Value and Teaching Style

The way information is presented greatly impacts its effectiveness. Highly academic language can be difficult to understand, while too much simplification can gloss over important details. Seek out books that strike a balance, teaching complex financial concepts in an accessible way without dumbing down the content. Additionally, consider the educational value of the guide; it should teach you not just the ‘how' but also the ‘why' of financial decisions, enabling you to make informed decisions independently long after you've finished the book.

Relevance and Up-to-Date Information

The finance world is ever-changing with new laws, technologies, and market dynamics. Therefore, it's important to look for books with the most recent publication date or ones that have been updated to reflect current financial realities. A guide to financial freedom should include contemporary topics such as digital assets, modern investment platforms, and current tax regulations. Check for the edition number to ensure that the information is not outdated and can be effectively applied in today's economic landscape.

Reader Reviews and Community Feedback

The experiences of past readers can offer valuable insights into the usefulness of a financial freedom guide. Look for books with positive reviews that highlight transformative results. Pay attention to what readers are saying about how the book changed their approach to managing money. However, be discernidable; consider reviews from multiple sources and beware of promotional or sponsored reviews. Interaction with an engaged community, such as online forums or social media groups discussing the book's strategies, can also be a testament to its effectiveness.

Cost and Value for Money

Last but not least, consider the price of the book in relation to the value it promises to deliver. Comparing prices across different retailers can help you find the best deal, but don't compromise on quality for the sake of cost alone. A higher-priced book that offers in-depth guidance and proven strategies could be more beneficial in the long run than a cheaper, less comprehensive guide. Additionally, check if the book comes with supplementary materials or additional online resources that may justify a higher price point.

By rigorously evaluating these aspects, potential customers can make an informed choice and select a financial freedom guide that will serve as a valuable resource on their path to achieving financial independence.

“`html

FAQ – Financial Freedom

What is financial freedom?

Financial freedom refers to the state where you have sufficient personal wealth to live, without having to work actively for basic necessities. It is when your passive income allows you to enjoy a desired lifestyle without a regular paycheck.

How much money do I need to achieve financial freedom?

The amount of money you need to achieve financial freedom varies based on your personal expenses, lifestyle choices, debts, and financial goals. A common approach is to calculate your annual living expenses and aim for a net worth that is 25 to 30 times that amount, based on the 4% withdrawal rule.

Is financial freedom the same as being rich?

No, financial freedom isn't synonymous with being rich. Being rich means you have a substantial amount of money, while financial freedom means you have enough to live your life the way you want without financial stress, regardless of your total wealth.

Can financial freedom be achieved by anyone?

Achieving financial freedom is a goal that many can strive for, but it requires a strategic approach to income, spending, saving, and investing. It may be more difficult for some depending on their financial starting point, economic factors, personal responsibilities, and financial literacy.

What are the first steps to achieving financial freedom?

The first steps to achieving financial freedom typically include creating a budget, reducing unnecessary expenses, establishing an emergency fund, paying off debt, and starting to invest early.

How does debt impact financial freedom?

Debt can significantly delay achieving financial freedom, as it often comes with high-interest rates that can hinder your ability to save and invest. Paying off high-interest debts is usually a priority to pave the way for financial independence.

What role does passive income play in financial freedom?

Passive income is crucial in achieving financial freedom as it generates earnings without the need for active work. This can include income from investments, rental properties, royalties, or business ventures that do not require your day-to-day involvement.

Is early retirement necessary for financial freedom?

Early retirement is not necessary for financial freedom, although some individuals choose this path. Financial freedom is about choice and flexibility—it means that you can choose to work, change careers, or retire based on preference rather than financial need.

༢p>

How does one manage risk on the path to financial freedom?

Managing risk involves diversifying investments, having an adequate emergency fund, obtaining insurance to protect against unforeseen events, and regularly reviewing and adjusting your financial plan to be in line with your goals and changes in circumstances.

What is the difference between financial freedom and financial independence?

The terms financial freedom and financial independence are often used interchangeably. However, financial independence tends to focus more on the ability to live comfortably without relying on employment income, while financial freedom extends the concept to include additional wealth that allows for a more luxurious lifestyle and broader choices.

“`

In conclusion, Grant Sabatier's “Financial Freedom” stands out as a pioneering guide for anyone eager to break free from the paycheck-to-paycheck lifestyle and achieve true financial independence. Sabatier's strategies are not just theoretical; they are practical, well-researched methods drawn from his own inspiring journey from financial despair to wealth within a few short years.

This book review has delved into the potent insights and benefits offered throughout the pages of “Financial Freedom,” highlighting how Sabatier provides actionable advice that is applicable regardless of one's financial starting point. Readers will find value in the book’s comprehensive approach to earning, saving, and investing, all designed to expedite the journey towards financial autonomy.

Whether you are in the early stages of your money management journey or well on your way, “Financial Freedom” offers a refreshing perspective on how to maximize your income, minimize your expenses, and invest your resources wisely. With accessible language and tangible steps, Sabatier empowers you to make informed decisions that align with your financial goals.

As we wrap up this review, it's clear that “Financial Freedom” is more than just a manual for accumulating wealth—it's a manifesto for living a richer, more fulfilling life. If you're seeking to make meaningful change in your financial fortunes and reclaim your time, this book is a practical and potentially life-altering read. Let Grant Sabatier's “Financial Freedom” guide you on your path to financial success and personal prosperity.

Other Financial Freedom buying options

Amazon and the Amazon logo are trademarks of Amazon.com, Inc, or its affiliates.