As an Amazon Associate I earn from qualifying purchases.

In an era where personal finance is often shrouded in overly complex jargon and unrealistic frugality mantras, Ramit Sethi's “I Will Teach You to Be Rich” emerges as a lighthouse for the financially adrift. This isn't just another book preaching the virtues of saving your morning latte money; it's a nuanced deep dive into the mechanics of money management for the generation that scoffs at the notion of one-size-fits-all financial advice. Sethi, with his straight-talking style, ensures you don't just skim through dry financial concepts but actually engage with them, understand them, and ultimately, wield them to your advantage.

Tackling the core problems of financial illiteracy and inaction, “I Will Teach You to Be Rich” operates on the conviction that managing money should be simple, actionable, and dare we say, enjoyable. Sethi cuts through the morass of intimidation that surrounds topics such as investing, budgeting, and navigating bank fees, infusing confidence in readers to take decisive steps towards their financial goals. Far from being a mere motivational pep talk, Sethi's book presents a six-week program equipped with battle-tested tips on automating your financial life, negotiating like a pro, and smartly handling credit. It is a clarion call for financial empowerment that resonates with the urgency of now, providing timeless advice that is especially pertinent in today's economic landscape.

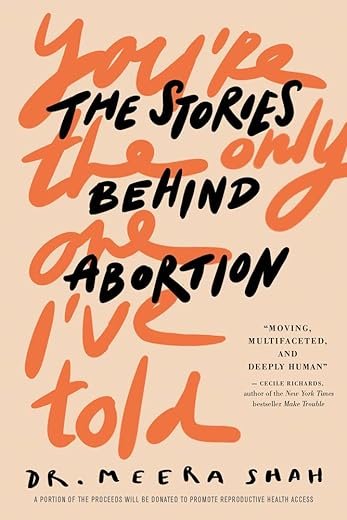

You're the Only One I've Told: The Stories Behind Abortion

Plot

I Will Teach You to Be Rich” is a financial guide aimed at a relatively young audience, including millennials, who may feel overwhelmed by the complex world of personal finance. The book doesnet follow a traditional narrative plot but is structured as a six-week program, with each week covering a different facet of personal finance management. Week one starts by debunking common financial myths and setting the reader on the right mindset for wealth-building. As the weeks progress, readers are guided through topics such as optimizing credit cards and bank accounts, opening high-interest savings accounts, and automating finances to ensure timely bill payments and savings contributions. The book also delves into investment strategies, including explanations on setting up retirement accounts and the basics of asset allocation. By the final week, Sethi offers advice on maintaining the reader's new financial system and touches on advanced investment strategies and the psychological aspects of wealth. Through illustrative case studies and examples, readers are shown the practical implications of financial missteps and the benefits of following Sethi's advice.

Characters

While “I Will Teach You to Be Rich” does not feature characters in the traditional literary sense, it heavily relies on personas representing typical young adults with certain financial behaviors and attitudes. Ramit Sethi introduces these archetypical figures to demonstrate common financial pitfalls or successes. For instance, he might introduce the reader to a character who is “The Over-Spender,” often falling prey to lifestyle inflation and a lack of financial planning. Alternatively, Sethi presents “The Saver,” someone with frugal habits but potentially excessive risk-aversion, which may lead to missed investment opportunities. These characters are then used to articulate financial concepts and behaviors, giving readers relatable scenarios that reflect real-life financial decisions. Through their stories and outcomes, Sethi illustrates the do's and don'ts of personal finance, rendering abstract concepts more tangible and understandable.

Writing Style

Sethi's writing style in “I Will Teach You to Be Rich” is informal, conversational, and peppered with humor. His tone is often light-hearted and irreverent, which makes the dense topic of personal finance more approachable and engaging. He breaks down complex financial jargon into simple, relatable language, which makes the content accessible to individuals who might be intimidated by more traditional financial literature. Sethi's use of anecdotes, metaphors, and rhetorical questions engages the reader directly and creates a sense of dialogue. He often anticipates readers' objections and addresses them head-on, a technique that helps to dispel common financial myths and excuses that prevent people from optimizing their economic lives. The book also includes actionable steps and practical advice, such as scripts for negotiating with banks and credit card companies, which demonstrate Sethi's direct and hands-on approach to financial education.

Setting

“I Will Teach You to Be Rich” is set against the backdrop of modern financial systems and everyday life. The setting isn't a physical place but rather the personal financial environment that readers inhabit. Sethi contextualizes his advice within the framework of real-world financial institutions, economic conditions, and consumer habits. He addresses the setting of twenty-first-century technology by advising readers on how to leverage online banking, investment tools, and automated financial services. Additionally, he takes into account the various settings in which individuals typically face financial decisions, such as at home when managing bills, in the workplace when deciding on retirement plans, or within the marketplace when engaging with different financial products. By anchoring his advice in the reader's everyday setting, Sethi ensures the content stays relevant and practically applicable.

Unique Aspects

One unique aspect of “I Will Teach You to Be Rich” is its blend of psychological insight with personal finance advice. Sethi delves into behavioral finance and explains how psychological factors like laziness, fear, and procrastination can impact financial decisions. His approach to addressing these mental blocks head-on and providing strategies to overcome them is a distinctive feature that sets the book apart from purely technical financial guides. Furthermore, Sethi's focus on big wins, such as negotiating salary or cutting major expenses, emphasizes high-impact financial strategies rather than merely cutting back on small discretionary expenses. Moreover, the book's six-week program structure promises a transformed financial state by the end, which is an appealing and motivating proposition for readers. Lastly, Sethi includes diverse case studies from his own consulting experience, offering a range of narratives about financial transformation that serve to inspire and instruct readers about the diverse ways to apply the book's principles.

Similar to I Will Teach You to Be Rich

“`html

table {

width: 100%;

border-collapse: collapse;

}

th, td {

border: 1px solid black;

padding: 8px;

text-align: left;

}

th {

background-color: #f2f2f2;

}

.pros-cons-section {

margin-bottom: 20px;

}

Pros of “I Will Teach You to Be Rich”

| Aspect | Impact on User Experience |

|---|---|

| Practical Advice | Readers receive actionable steps, improving the likelihood of financial success and user satisfaction. |

| Behavioral Approach | The focus on behavior over numbers helps users easily relate and apply concepts, enhancing engagement. |

| Automation Strategies | User experience is improved by learning how to automate finances, which simplifies money management. |

| Accessible Language | Jargon-free explanations make the content more accessible to beginners, increasing comprehension. |

| Focus on Long-Term Wealth | Encourages users to create sustainable habits that contribute to long-term success, fostering trust and credibility. |

Cons of “I Will Teach You to Be Rich”

| Aspect | Impact on User Experience |

|---|---|

| Limited Scope | May not cover all aspects of personal finance, which could leave users seeking additional resources. |

| American-Centric | Non-US readers may find some advice less applicable, potentially reducing the book's global appeal. |

| Assumes Stable Income | Users with irregular income might find it harder to implement the book's strategies, leading to frustration. |

| Potential Over-simplification | Some users seeking depth in financial education might find the content too simplified, impacting perceived value. |

| Investment Strategy Criticism | Users may find the recommended investment strategies too conservative or aggressive for their taste, affecting satisfaction. |

“`

The above HTML snippet uses tables to outline the pros and cons of the book “I Will Teach You to Be Rich.” Each pro and con is discussed in terms of its impact on the user experience. The tables feature solid 1px black borders around each cell for visual distinction. The use of `th` tags for headings aids in the clarity and organization of the analysis.

Evaluating Author Credibility

When selecting a book like “I Will Teach You to Be Rich,” one of the first things to consider is the credibility of the author. Ramit Sethi, the mind behind this bestseller, is a widely recognized personal finance advisor and entrepreneur. Before making a purchase, research the author's background, expertise, and other works. Check for their educational qualifications, experience in the finance industry, and professional accomplishments. An author with a strong reputation and a history of helping others improve their financial health is more likely to provide valuable insights and practical advice.

Understanding the Book's Approach and Philosophy

It's important to understand the approach that “I Will Teach You to Be Rich” takes towards personal finance. The book adopts a no-nonsense, six-week program that focuses on actionable steps. Potential buyers should look for information on the book's methodology and philosophy, ideally through reviews and summaries available online. Understanding how the book aligns with your personal financial goals and learning style is also crucial. Does it advocate for aggressive investment strategies, frugality, or balanced financial planning? Making sure the book's philosophy resonates with your own can greatly impact its effectiveness for you.

Comparing Content Quality and Reliability

Consider the content quality and reliability when choosing a financial advice book. “I Will Teach You to Be Rich” is known for its straightforward language and actionable advice, but how does it compare to other books in the same genre? Look for expert reviews and reader testimonials to gauge whether the financial strategies presented are sound, well-researched, and applicable to a wide audience. Verify the sources of any statistical data or financial claims and check if the book has been updated to reflect current financial laws and market conditions.

Analyzing Reviews and Testimonials

Reviews and testimonials provide invaluable insights from readers who have applied the book's principles. When browsing for “I Will Teach You to Be Rich,” pay close attention to feedback from individuals who share your financial outlook and goals. Platforms like Amazon, Goodreads, and financial forums host a myriad of user reviews that can alert you to the book's strengths and weaknesses. Be wary of overly promotional or exceedingly negative reviews, as they may not provide objective information.

Assessing Additional Resources and Support

Many personal finance books come with additional resources, such as worksheets, templates, or access to online communities. These can enhance your learning experience and help implement the book's advice. Investigate whether “I Will Teach You to Be Rich” offers supplemental materials or online support. Some editions might include access to budget planning tools or membership in a private finance group, which can offer ongoing support as you apply the book's teachings to your financial life.

Checking for Updated Editions

Personal finance is an ever-evolving field, and staying current is key. Ensure you're getting the most relevant and up-to-date information by checking for the most recent edition of “I Will Teach You to Be Rich.” Look for information regarding updates to tax laws, investment strategies, and savings methods. An updated edition may also address economic changes and trends that could significantly impact your personal finance decisions.

Price Comparison and Value

Finally, compare prices across different retailers to ensure you're getting the best deal for your investment. While the cost of the book is important, also consider the value of the knowledge and tools it provides. A higher-priced book with proven strategies and numerous success stories could offer better value in the long run than a cheaper, less reliable alternative. Keep an eye on sales, discounts, and bundle offers as well, which can provide additional savings without compromising on quality.

“`html

FAQ – I Will Teach You to Be Rich

What is “I Will Teach You to Be Rich” about?

I Will Teach You to Be Rich is a personal finance book by Ramit Sethi that focuses on helping readers create a practical approach to managing their finances. It covers a range of topics such as budgeting, saving, investing, and negotiating, with an aim to help readers live a “rich life” based on their own definitions of wealth and happiness.

Is “I Will Teach You to Be Rich” suitable for beginners?

Yes, the book is designed for individuals of all levels, including beginners. It emphasizes simple, actionable steps that anyone can take to improve their financial situation. The language used is approachable, and concepts are explained in a way that is easy to understand for those who are new to personal finance.

Does the book provide specific financial advice or is it more general?

The book provides a mix of specific financial advice and general principles. While it does offer concrete strategies for money management, such as how to automate your finances or the exact scripts to use when negotiating with banks, it also imparts broader lessons on wealth building and financial decision-making.

Is the advice in “I Will Teach You to Be Rich” applicable to non-USA residents?

While many of the concepts in “I Will Teach You to Be Rich” are universally applicable, some of the specific advice (such as details about retirement accounts and investment options) is tailored to residents of the USA. International readers can still benefit from the book's general principles and adapt the strategies to their own country's financial products.

How long will it take to see results after implementing the book's strategies?

The timeline for seeing results can vary significantly depending on your starting point, the specific strategies you implement, and your consistency in following the book's advice. Some readers may notice immediate savings after negotiating bills or setting up a no-fee bank account, while others may see longer-term results from consistent investing. The key is to apply the lessons consistently over time.

Can this book help me if I have debt?

Yes, “I Will Teach You to Be Rich” addresses the topic of debt management and provides strategies for dealing with both student loans and credit card debt. It offers a practical framework for prioritizing and paying off your debt while still saving and investing for your future.

Do I need to earn a high income to benefit from the book's advice?

No, the book is designed to provide value to individuals across different income levels. It focuses on optimizing your spending, saving, and investing no matter what your income is, by teaching you how to make the most of the money you have.

How updated is the advice in “I Will Teach You to Be Rich”?

The original edition of “I Will Teach You to Be Rich” was published in 2009, and a second edition with updated advice and additional material was released in 2019. The updated edition reflects changes in the financial landscape and provides fresh insights based on Ramit Sethi's continued research and reader feedback.

“`

In conclusion, “I Will Teach You to Be Rich” by Ramit Sethi stands not only as an empowering guide to personal finance but also as a practical roadmap to achieving financial independence. Our in-depth review has highlighted the book's unique approach to money management that combines psychological insights with actionable advice. Sethi dispels the myth that being rich is unattainable and instead provides the reader with the tools and knowledge necessary to make informed financial decisions.

By adopting Sethi's 6-week program, readers are equipped to tackle debt, effectively manage their investments, and strategically plan for a prosperous future. The book goes beyond mere theory, presenting case studies and real-life examples that bring the concepts to life and ensure applicability. It's not just about becoming wealthy; it's about understanding the value of money and how to make it work for you.

I Will Teach You to Be Rich” is a valuable choice for anyone seeking to take control of their financial destiny. The insights and benefits offered in this book can lead to lasting changes in one's financial behavior, leading to a richer and more fulfilling life. Whether a financial novice or someone looking to refine their budgeting and investing strategy, Sethi’s guide proves to be an indispensable resource on the journey to financial literacy and affluence.

Other I Will Teach You to Be Rich buying options

Amazon and the Amazon logo are trademarks of Amazon.com, Inc, or its affiliates.