As an Amazon Associate I earn from qualifying purchases.

Since its initial publication in 1949, Benjamin Graham's seminal work, “The Intelligent Investor,” has stood the test of time, securing its place as the cornerstone of investment philosophy. A tome that has been whispered in the corridors of finance and revered by the world's most successful investors, including Warren Buffett, the book cuts through the cacophony of market noise and delivers a methodology that is as prudent as it is profound. Catering to both the novice and the seasoned financier, Graham's insight into the psychology of investing and the mechanics of the market remains startlingly relevant, transcending the relentless evolution of financial landscapes.

“The Intelligent Investor” does not merely illuminate pathways to financial gain; it delineates a discipline designed to safeguard the investor from the all-too-human penchant for error. Graham's principles of “value investing” – investing with a margin of safety, distinguishing investment from speculation, and the importance of being ‘contrarian' – provide a toolkit to navigate the treacherous terrain of market fluctuations and irrational exuberance. It resolves a fundamental predicament faced by investors: how to achieve long-term wealth creation without falling victim to the market's seductive, speculative temptations that so often lead to ruin. The book’s enduring wisdom offers a time-tested beacon, guiding investors through economic upheavals and towards the serene waters of financial security.

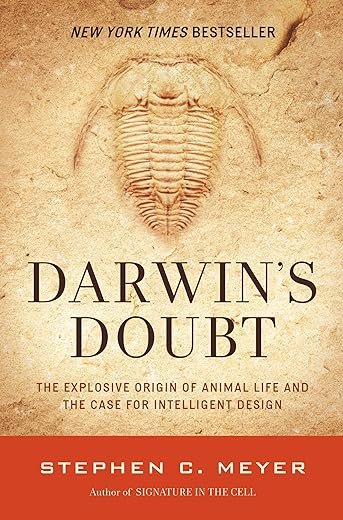

Darwin's Doubt: The Explosive Origin of Animal Life and the Case for Intelligent Design

Plot

The term “plot” is not entirely applicable to “The Intelligent Investor” as it is a non-fiction book focusing on investing and finance rather than a story with a narrative arc. Nonetheless, the core content revolves around the prudent investment strategies that Benjamin Graham advocates. Graham concentrates on the importance of investing rather than speculative, short-term trading. He introduces the concept of “Mr. Market,” a metaphorical figure representing the stock market's fluctuations, to illustrate how an intelligent investor should react to market volatility with disciplined, rational decision-making instead of emotional responses. He divides investors into two categories: the defensive (passive) and the enterprising (active), detailing strategies suitable for each group and emphasizing the importance of fundamental analysis, the margin of security, and a disciplined approach as essential components for success in the investment realm.

Characters

While there are no fictional characters in “The Intelligent Investor,” Benjamin Graham personifies the market as “Mr. Market” to illustrate his teachings. Mr. Market is presented as a manic-depressive business partner who offers to sell his share of their business or to buy the investor's share every day. Graham uses Mr. Market to exemplify the irrational and often whimsical nature of the stock market. Additionally, Graham references historical figures and leading investors, such as himself and his famous disciple Warren Buffett, to underpin his investment principles. These real-life characters serve as case studies and role models for successful application of the book's investing strategies.

Writing Style

“The Intelligent Investor” is written with a formal, authoritative tone befitting an educational text on investment. Graham's writing style is analytical and didactic, aimed at conveying complex financial concepts in a clear and concise manner. He often uses analogies and personifications, like the aforementioned Mr. Market, to simplify abstract ideas and make them more relatable to the reader. The book includes numerous examples and case studies, allowing readers to see the real-world application of Graham's investment philosophy. Furthermore, Graham's style is at times cautionary, warning readers of the pitfalls of ignoring the fundamental principles of investing, and at the same time, it is encouraging, offering guidance on how to make sound investment choices.

Setting

The setting of “The Intelligent Investor” is the financial investment landscape, primarily the U.S. stock market, from around the 1920s through the mid-20th century, when the book was first published in 1949. Graham draws extensively on the events of the Great Depression, the stock market crash of 1929, and periods of both economic prosperity and downturns to provide contextual background for his investment advice. The temporal setting of the book spans several decades, which allows Graham to demonstrate the efficacy of his strategies over long periods, reinforcing his advocacy for long-term investing. The revisions and commentaries in the updated editions of the book extend the setting into the contemporary market environment, showcasing the timeless relevance of Graham's principles.

Unique Aspects

“The Intelligent Investor” is distinguished by its pioneering approach to value investing, an investment paradigm that emphasizes buying securities that appear underpriced by some form of fundamental analysis. Among its unique aspects is the introduction of the concept of “margin of safety,” which is the practice of investing with a significant discount to the intrinsic value of a security to minimize downside risk. Another notable feature is its audience differentiation, as Graham discreetly addresses both the defensive and the enterprising investor, acknowledging that different investors have different levels of time, interest, and expertise. The book's enduring relevance is underscored by its emphasis on investor psychology, risk management, and financial discipline, principles that have stood the test of time and market evolution. Lastly, the appendices and footnotes added by subsequent editors, such as Jason Zweig, provide contemporary interpretations and applications of Graham's principles, bridging the gap between the original publication and the modern investment world.

Similar to The Intelligent Investor

Below is the HTML format for presenting a thorough analysis of the pros or cons of “The Intelligent Investor,” with styled sections using solid 1px black borders.

“`html

table {

width: 100%;

border-collapse: collapse;

}

th, td {

border: 1px solid black;

padding: 8px;

text-align: left;

}

th {

background-color: #f2f2f2;

}

.pros {

background-color: #e7f4e4;

}

.cons {

background-color: #f4e4e4;

}

| Pros of The Intelligent Investor | |

|---|---|

| Timeless Investment Principles | The advice provided in the book is based on fundamental principles of value investing that are as relevant today as when the book was first published. |

| Risk Management | Benjamin Graham focuses on risk management, teaching investors how to analyze and minimize risk. |

| Investor Psychology | The book provides insights into the psychology of investing, helping readers to avoid emotional decision-making. |

| Detailed Analysis | Graham provides detailed analysis frameworks for stocks which are essential for any serious investor. |

| Cons of The Intelligent Investor | |

|---|---|

| Complex Concepts | Some beginners may find the concepts difficult to grasp due to the detailed and technical nature of the writing. |

| Outdated Examples | The examples used in the book are from Graham's time and thus may no longer be applicable to today's market conditions. |

| Value Investing Focus | Investors with interest in other styles of investing may find the heavy focus on value investing too narrow or limiting. |

| Lengthy Read | The density of the subject matter can make the book a lengthy read, possibly overwhelming for new investors.</gers for some readers, potentially hindering their understanding and application of the concepts. |

“`

Each `pros` and `cons` row is clearly demarcated with a background color and a solid black border, making the separate sections of the analysis stand out for the reader. The structured approach takes the reader directly to the points of analysis without any preamble or closing remarks.

Editions and Publishing Date

When you're on the lookout for “The Intelligent Investor” by Benjamin Graham, the edition you choose is critical. Originally published in 1949, this book has seen several revisions. The most influential and widely read is the revised edition with commentary by Jason Zweig. Zweig's annotations provide contemporary insights which connect Graham's principles to the modern financial world. Make sure to check the publishing date to ensure you are purchasing an edition with the latest insights and forwarded by a respected figure in the investment community.

Paperback vs. Hardcover vs. E-Book

Decide on the format that best meets your needs. A paperback is typically more affordable and portable, a good choice for the budget-conscious reader who plans to carry the book around. Hardcovers are durable and often considered collectible, appealing if you're looking for a long-lasting reference copy for your library. E-books offer immediate delivery and the convenience of having the book on various devices, perfect for digital-savvy readers with a preference for e-readers or tablets.

Condition of the Book

If you're opting for a physical copy, consider the condition of the book. New books come at a higher cost but assure you of mint condition without markings or wear. Used books can offer significant savings but evaluate the vendor's rating and reviews to avoid heavily annotated or damaged copies. Look for descriptions of the book's state and ensure a return policy is in place if the item doesn't meet your standards upon arrival.

Complementary Resources

Some editions of “The Intelligent Investor” come packaged with supplementary materials like study guides, summaries, and questionnaires that enhance your understanding. These resources are especially beneficial for beginners or readers who plan to study Graham's concepts in depth. Verify the book’s listing to see what additional content, if any, is included. Investing in such a bundle can be more effective than buying a standalone book.

Price Comparison

Prices for “The Intelligent Investor” can vary significantly from one seller to another. Check various bookstores, both online and brick-and-mortar, to compare prices. Online marketplaces often have competitive rates and options for both new and used books. Watch out for discounts, special offers, or book sales to get the best value for your purchase. Always factor in the shipping costs if you're buying online, as it might affect the total price.

Reviews and Ratings

It's beneficial to read reviews from other readers to gauge whether “The Intelligent Investor” matches your learning style and investment knowledge level. High ratings often indicate a positive consensus, but delve into the reviews for specifics about what readers found valuable. Pay attention to reviews from reputable sources or individuals with investment expertise for professional insights into the book’s concepts.

Vendor Reputation and Reliability

Purchasing from a reputable seller is crucial to ensure that you receive an authentic copy of “The Intelligent Investor.” Check the vendor’s reputation, especially when buying from third-party sites. Look for vendors with high ratings and positive feedback on customer service, authenticity of the books sold, packaging, and shipping times. It's important to have confidence in the seller, especially if you're making your purchase online.

Personal Investment Goals

Consider how “The Intelligent Investor” aligns with your personal investment goals and experience level. Benjamin Graham’s book is geared towards value investing and provides fundamental investing philosophies. If this matches your interest in long-term investing and risk management, it’ll be a beneficial read. Those seeking more aggressive trading strategies may want to complement this book with other resources.

By focusing on these factors, you can navigate the options available for purchasing “The Intelligent Investor” and select the edition that will best serve your needs as a savvy investor.

“`html

FAQ – The Intelligent Investor

What is The Intelligent Investor about?

The Intelligent Investor is a book that delves into the philosophy of “value investing” – a strategy focused on making long-term investment decisions to maximize wealth. Originally written by Benjamin Graham, this book guides readers on how to develop a disciplined investment approach and avoid the common pitfalls in the stock market.

Is The Intelligent Investor suitable for beginners?

Yes, the book is highly recommended for beginners as it lays out the foundation of investment philosophy and principles in an accessible manner. While some concepts may be complex, the book is considered a must-read for anyone starting their journey in the world of investing.

Has The Intelligent Investor been updated since Benjamin Graham's time?

While Benjamin Graham's original text remains unchanged, there have been subsequent editions with commentary and footnotes by other finance and investment experts, such as Jason Zweig. These updates help to bridge Graham's insights with contemporary examples and the modern financial market's context.

What is the core philosophy of The Intelligent Investor?

The core philosophy of The Intelligent Investor is centered on the approach of value investing, which involves buying securities that appear underpriced by some form of fundamental analysis. Graham emphasizes the importance of investor psychology, margin of safety, and the difference between investing and speculating.

How does The Intelligent Investor address risk?

Graham discusses risk primarily through the concept of “margin of safety” — buying securities at a significant discount to their intrinsic value to minimize the chance of loss. He also advises diversification and a disciplined approach as key elements in risk management.

Can the strategies in The Intelligent Investor still be applied today?

Yes, the principles and strategies described in The Intelligent Investor are considered timeless and can still be applied in today's market; however, investors must take into account the changes in market dynamics, regulations, and instruments that have occurred since the book's publication.

What is meant by ‘Mr. Market' in The Intelligent Investor?

‘Mr. Market' is an allegory used by Benjamin Graham to illustrate the market's volatile nature. It represents the collective mood swings of investors, from optimism to pessimism, and Graham uses it to teach readers not to be swayed by the market's fluctuations but to focus on the underlying value of investments.

Does The Intelligent Investor talk about specific stock picks?

No, The Intelligent Investor does not focus on recommending specific stock picks. Instead, it provides a framework for evaluating investments and developing an individualized strategy based on solid principles of value investing.

“`

In conclusion, “The Intelligent Investor” by Benjamin Graham is more than just a book; it is an invaluable resource for anyone seeking to navigate the complex world of investing. Graham's timeless wisdom offers insights that are just as relevant today as when the book was first published. His philosophy of value investing and the concept of ‘Mr. Market' provide investors with the strategies needed to achieve long-term financial success and prevent costly errors driven by emotions or market pressures.

By diving into the principles outlined in “The Intelligent Investor,” you'll gain not just knowledge of how to assess the intrinsic value of a stock, but also the discipline required to stick with sound investment principles. Graham's emphasis on investor psychology, defensive investing, and his clear differentiation between investing and speculating, make this book a must-read for both novice and experienced investors alike.

Whether you're just starting your investment journey or looking to refine your approaches, “The Intelligent Investor” delivers invaluable lessons and actionable advice that can help safeguard your portfolio and maximize your growth potential. With its enduring wisdom and guidance on making wise investment choices, it is clear why “The Intelligent Investor” is often heralded as the bible of investing. Reading and applying the knowledge from Benjamin Graham's masterpiece can set you on a path to financial stability and success, making it an extraordinarily beneficial addition to your personal library.

Other The Intelligent Investor buying options

Amazon and the Amazon logo are trademarks of Amazon.com, Inc, or its affiliates.