As an Amazon Associate I earn from qualifying purchases.

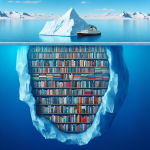

Unmasking the nondescript veil of America's true wealth, “The Millionaire Next Door” shatters the glittering montage of luxury often associated with millionaires. Thomas J. Stanley's pivotal work, co-authored with William D. Danko, delves deep into the lives of real millionaires—ones you wouldn’t recognize on the street—the kind who live right next door. Sobering and revelatory, the book uncovers the day-to-day realities of individuals who have amassed substantial wealth not through inheritance or luck, but through methodical, mundane means. Drawing on extensive research and interviews, Stanley and Danko expose the traits and habits that correlate with financial prosperity, challenging the very archetype of affluence propagated by media and societal stereotypes.

The significance of “The Millionaire Next Door” resides not just in its empirical underpinnings but also in its pragmatic approach to rectifying misapprehensions about wealth. It solves the mystery of why some people accumulate wealth while others, often with higher incomes, do not. The book serves as both a myth-buster and a guide, debunking the misconceptions that luxury equals wealth and identifying behaviors that can lead to financial independence. Through its rigorous analysis, it offers a series of principles that promise to guide the average earner away from the ephemeral allure of consumption and toward the path of long-term asset accumulation. This book does not tell a tale of unattainable riches; it is a mirror held up to the financial habits of all, revealing the often-overlooked truth that millionaire status may be just a few small but disciplined habits away.

People who viewed this also viewed

Plot

The “plot” in “The Millionaire Next Door” is non-trivial, as the book is not a work of fiction but a compilation of research findings and analyses. The core narrative, however, examines the common traits, behaviors, and habits that are prevalent among individuals who have accumulated significant wealth, often in ways that defy conventional wisdom. It systematically dismantles the typical image of millionaires by revealing that true wealth is often invisible, found in unassuming individuals who live modestly, invest wisely, and spend below their means. The book guides the reader through various statistical outcomes and personal anecdotes that demonstrate how these millionaires quietly amass and sustain their fortunes, often through discipline, hard work, and an unspectacular lifestyle.

Characters

While “The Millionaire Next Door” does not have characters in the fictional sense, it presents profiles of real-life millionaires as the protagonists of its financial narratives. These individuals represent the antithesis of the high-spending, flashy stereotype often associated with wealth. The “characters” within the book are distilled from a variety of detailed case studies and interviews conducted by the authors. They become the faces of concepts like frugality, industriousness, and financial acumen. For instance, the reader is introduced to characters like the small business owner who drives an older-model car and lives in a middle-class neighborhood, all while quietly accumulating a seven-figure net worth. These profiles serve as instructive examples for the financial behaviors and choices that can lead to significant wealth accumulation.

Writing Style

The book’s writing style is characterized by a blend of authoritative analysis and accessible anecdotal evidence. It is both informational and conversational, making complex financial concepts understood by a broader audience. The authors use a research-driven approach to present their findings, frequently incorporating figures, tables, and charts to substantiate their points. Additionally, they employ various case studies that add a narrative depth to the statistical data, thus allowing readers to engage more deeply with the material. The style could be described as a mix of academic vigor and mainstream appeal, which often conveys a sense of mentorship to the reader as if the authors are providing a blueprint for achieving financial independence.

Setting

“The Millionaire Next Door” is set in late 20th-century America, during a time when consumer culture and the perception of wealth were dominated by visible signs of affluence. In this context, the book investigates the everyday environments of millionaires, which are typically far removed from the glamor of Hollywood or the opulence of Wall Street. Instead, the text locates its subjects in unassuming neighborhoods, average suburban homes, and within traditional professions or small businesses. The setting underscores one of the book's central theses: that wealth accumulation often occurs incrementally over time and within the confines of ordinary daily life. By focusing on these ordinary settings, the authors convey the accessibility of wealth building to the average American.

Unique aspects

One of the most unique aspects of “The Millionaire Next Door” is its rigorous debunking of the myth that wealth is usually inherited or the result of high-profile careers. Instead, it illustrates that many millionaires are self-made and have accumulated their wealth through prudent investing and frugality. The concept of “UAWs” (Under Accumulators of Wealth) versus “PAWs” (Prodigious Accumulators of Wealth) is another distinguishing feature of the book, offering readers new terminology to classify financial behavior. Furthermore, the focus on behaviors rather than mere financial metrics gives the book an actionable quality; it doesn't just describe wealth, it prescribes the practices needed to attain it. The book also stands out for its timelessness; despite being published in the 1990s, its principles remain largely applicable in the modern economic landscape, making it a perennial favorite in personal finance literature.

Similar to The Millionaire Next Door

Below is an HTML markup using the `

| Pro | Impact on User Experience |

|---|---|

| Encourages Frugality | Readers may adopt more disciplined spending habits, benefiting their financial health. |

| Focus on Self-made Wealth | Inspires users to pursue wealth through hard work and entrepreneurship, fostering a sense of empowerment. |

| Research-based Insights | Provides credibility to the advice, making users more likely to trust and implement the strategies. |

Cons of The Millionaire Next Door

| Con | Impact on User Experience |

|---|---|

| Outdated Information | The data may not reflect current economic conditions, potentially misleading readers. |

| Overemphasis on Frugality | May discourage users from enjoying life's pleasures or investing in self-development opportunities. |

| Lack of Diverse Perspectives | The book's insights may not be applicable to everyone, leading to a narrow user experience for some readers. |

“`

This HTML document creates two tables; one lists the pros of “The Millionaire Next Door” and the other lists the cons. Each important point is in its row, with an accompanying explanation of its impact on the user experience. Using CSS, the tables are formatted with solid black borders, and shading is applied to differentiate between pros and cons, enhancing readability and focus.

Understand the Core Message

When considering the purchase of “The Millionaire Next Door” by Thomas J. Stanley and William D. Danko, it is crucial to comprehend the book's core message. This influential work delves into the habits and characteristics of Americans who have accumulated significant wealth, often without flashy lifestyles or high-profile occupations. It challenges the conventional understanding of millionaires, presenting instead the concept of ‘stealth wealth.' Before buying, reflect on whether this analytical and data-driven approach to understanding wealth accumulation aligns with your interests in personal finance and self-development.

Evaluate Your Personal Finance Goals

Prospective readers should evaluate their personal finance goals and how they align with the lessons shared in the book. “The Millionaire Next Door” provides strategies for effective wealth building, such as living below your means and eschewing materialistic displays of wealth. It is tailored towards individuals who are serious about long-term financial planning and are willing to consider behavioral changes to achieve financial independence. Ensure that your goals resonate with these themes to get the most out of the book.

Author Expertise and Research Methods

It is important to consider the expertise of Thomas J. Stanley and William D. Danko, both of whom have extensive backgrounds in studying affluent individuals. The book bases its findings on years of research and surveys, providing an empirical foundation for its insights. Potential readers should value evidence-based conclusions when evaluating this book against others in the personal finance realm. Furthermore, a critical look at the research methods used will reveal the depth and validity of the study, reassuring you of the book's credibility.

Consider the Edition and Format

Variations such as hardcover, paperback, ebook, and audiobook editions of “The Millionaire Next Door” are available. Your choice should be influenced by your preferred reading method. If you enjoy physical books, the hardcover or paperback options may be ideal. For convenience, the ebook may be practical for reading on various digital devices, while the audiobook format could suit those who prefer listening to content during commutes or while multitasking. Pricing can also vary by format, so consider what fits best within your budget.

Read Reviews and Feedback

Before making a purchase, reading reviews and feedback from other readers can provide valuable insight into how the book has impacted and benefited others. Look for commentary from reputable sources as well as everyday readers to gain a balanced view of the book's reception. Consider both positive and critical reviews to understand any potential shortcomings or limitations of the book, and how it has effectively influenced readers' perspectives on wealth and frugality.

Compare with Similar Books

To make an informed decision, compare “The Millionaire Next Door” with similar books in the personal finance and wealth management genre, such as “Rich Dad Poor Dad” by Robert Kiyosaki or “Your Money or Your Life” by Vicki Robin and Joe Dominguez. Assess how each book approaches financial education and which strategies are offered. This will allow you to select a book that best suits your learning style and financial aspirations. Consider whether you're looking for anecdotal advice, practical tips, or research-driven insights. Doing so will ensure you select a resource that aligns with your preferences and needs.

Price Consideration

Price can be an influencing factor when purchasing any book. Compare prices across different retailers to find the best deal for “The Millionaire Next Door.” Keep an eye out for discounts, sales, or used book options if you are budget-conscious. Investing in a book is an investment in knowledge, so weigh the cost against the potential long-term benefits you can gain from applying its wisdom to your life.

Longevity and Timelessness

Last but not least, consider the longevity and timelessness of the book's content. “The Millionaire Next Door” has been impactful since its first publication in the 1990s, with principles that have stood the test of time. Think about whether you are looking for current trend analysis or time-tested wisdom when selecting your next financial read. If the latter resonates with you, this book's enduring popularity and continued relevance may be significant factors that influence your purchase decision.

FAQ for The Millionaire Next Door

What is the main message of “The Millionaire Next Door”?

The main message of “The Millionaire Next Door” is that the majority of millionaires live below their means and have accumulated their wealth through frugality, smart investment, and hard work, rather than through high-income professions or lavish lifestyles. They tend to prioritize financial independence over displaying high social status.

Who are the authors of the book and what are their credentials?

“The Millionaire Next Door” is co-authored by Thomas J. Stanley and William D. Danko. Thomas J. Stanley was a researcher and author specializing in the affluent market in America, with a Ph.D. in business from the University of Georgia. William D. Danko is a marketing professor at the State University of New York at Albany, with a Ph.D. from the Rensselaer Polytechnic Institute.

Can “The Millionaire Next Door” be considered a guide to becoming a millionaire?

While not a step-by-step guide, “The Millionaire Next Door” offers insights into the common traits and behaviors of millionaires that can serve as guidance for individuals looking to build wealth. It emphasizes long-term financial planning, living within one's means, and investing wisely.

Is the information in “The Millionaire Next Door” still relevant today?

Many of the principles in “The Millionaire Next Door” about wealth accumulation and frugality are considered timeless. However, readers should take into account changes in the economy, technology, and societal norms when applying its advice to the present day.

Does the book provide statistical evidence to support its claims?

Yes, “The Millionaire Next Door” is based on extensive surveys and interviews conducted by the authors with millionaires in the United States. It presents a variety of statistics and findings that underscore the lifestyle and habits of the affluent segment they studied.

Is “The Millionaire Next Door” suitable for readers with no background in finance or economics?

Absolutely. The book is written in an accessible manner and is intended for a general audience. It does not require prior knowledge of finance or economics to understand the concepts and suggestions it presents.

How does the book address the idea of inherited wealth?

“The Millionnaire Next Door” examines both self-made millionaires and those who have inherited wealth. However, the book largely focuses on individuals who have earned their fortune through their own means and emphasizes the behaviors that have enabled them to accumulate wealth over time, as opposed to those who have merely inherited it.

What kind of criticisms has “The Millionaire Next Door” received?

Critics of “The Millionaire Next Door” have pointed out that it may oversimplify the path to wealth and overlook external factors that can influence an individual's ability to accumulate wealth, such as socioeconomic background, education, and luck. Additionally, some argue that the book's findings are dated and do not fully account for the economic realities of the 21st century.

In conclusion, ‘The Millionaire Next Door' by Thomas J. Stanley offers a thought-provoking examination of the real traits and habits that lead to wealth in America. Far from the lavish lifestyles of the rich and famous we often see depicted in media, this book reveals that true financial success is often the result of frugality, smart investment, and the kind of perseverance that’s typically unaccompanied by fanfare.

Through comprehensive research and an array of compelling anecdotes, Stanley strips away the myths surrounding millionaires and uncovers the mundane realities of accumulating wealth. The book persuasively argues that anyone can achieve financial independence with the right mindset and discipline, making it an invaluable read for those looking to understand the principles of responsible wealth building.

Readers will walk away with practical insights on how to grow their net worth by living below their means, avoiding the trap of conspicuous consumption, and fostering the attributes that many self-made millionaires share. Whether you’re just starting out on your financial journey or looking for ways to protect and enhance your nest egg, ‘The Millionaire Next Door' is a compelling guide that offers enduring benefits and is a choice well worth considering for your next read.

Other The Millionaire Next Door buying options

Amazon and the Amazon logo are trademarks of Amazon.com, Inc, or its affiliates.