As an Amazon Associate I earn from qualifying purchases.

In the realm of personal finance, few texts are as enduring and revered as George S. Clason's “The Richest Man in Babylon.” This classic financial tome dispenses wisdom through tales and parables set in the ancient city of Babylon, once a symbol of wealth and prosperity. Within its pages lies the blueprint for accumulating wealth, a treasure trove of knowledge that has stood the test of time, captivating readers with its simplicity and actionable concepts. As pertinent today as it was when it first appeared in the 1920s, Clason's guide cuts through the complexity of modern finance by wrapping its teachings in engaging narratives that reflect on common financial pitfalls and the timeless principles for overcoming them.

The book's enduring appeal lies not merely in its nostalgic allure but in the concrete solutions it offers to the universal problem of financial insecurity. By following the journey of Arkad, purportedly Babylon's wealthiest man, readers are imparted with strategies for debt elimination, disciplined savings, and prudent investment—all distilled into memorable maxims such as “pay yourself first” and “guard thy treasures from loss.” Emblematic of a bygone era yet undeniably forward-looking, “The Richest Man in Babylon” offers a manual for financial success that resonates with novice savers and seasoned investors alike, demonstrating that the golden keys to wealth accumulation are eternally engrained in disciplined practice and wise decision-making.

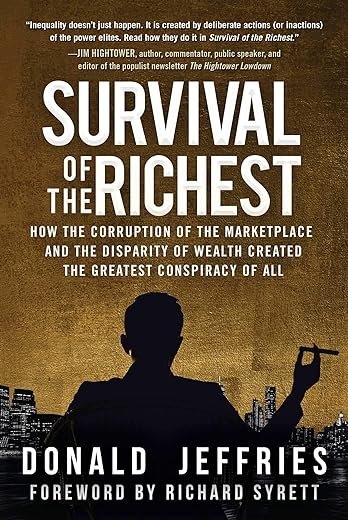

Survival of the Richest: How the Corruption of the Marketplace and the Disparity of Wealth Created the Greatest Conspiracy of All

Plot

The Richest Man in Babylon, penned by George S. Clason, unfolds as a series of parables set in ancient Babylon, each illustrating a financial principle or moral pertinent to wealth accumulation and personal finance. One of the central tales is that of Arkad, a humble scribe who rises to become the wealthiest man in Babylon through adherence to simple yet effective financial wisdom. Told through conversations and experiences, Arkad shares his knowledge with fellow Babylonias, offering them advice on how to save wisely, invest, and grow their wealth. Alongside Arkad's story, other parables address various financial challenges and solutions, such as the tale of a chariot builder, a musician, and others who seek to escape a life of poverty or financial mediocrity. The narrative structure serves to reinforce the practicality of the financial lessons imparted, demonstrating how the ancient wisdom remains relevant and applicable to contemporary economic situations.

Characters

In “The Richest Man in Babylon,” the characters symbolize varied societal roles and positions as they navigate financial realities. Arkad, who stands at the narrative's center, represents the archetype of wisdom and discipline in wealth creation. His metamorphosis from a modest scribe to the richest man illuminates the virtues of knowledge and patience. Other characters, such as Bansir the chariot builder, personify common struggles with money and the pursuit of financial stability. Each character's journey serves to provide a distinct perspective on wealth and its attainment, allowing readers to relate to at least one of the characters' experiences. Kobbi, the musician, and Dabasir, the camel trader, for instance, offer insights into the consequences of poor financial decisions and the path to redemption and fiscal responsibility. Collectively, these characters serve as vehicles for delivering Clason's financial advice, making the wisdom both accessible and engaging to the reader.

Writing Style

Clason’s writing style in “The Richest Man in Babylon” is marked by its simplicity and narrative clarity, rendering it both instructive and engaging for a wide audience. He adopts a didactic approach through storytelling, facilitating the reader's absorption of financial principles in a non-academic, conversational tone. The prose often takes on a parabolic and somewhat archaic language that mirrors the setting of ancient Babylon, imbuing the text with an air of timelessness and wisdom. Despite the antique-style language, Clason manages to present economic concepts in an accessible and easily understandable manner. He employs repetition of key maxims such as “A part of all you earn is yours to keep,” which aids in memorizing the core lessons. This approach reinforces the underlying financial teachings, making them memorable and actionable.

Setting

The setting of ancient Babylon plays a crucial role in “The Richest Man in Babylon,” providing not only a historical backdrop but also a metaphorical foundation upon which the financial principles stand. Babylon was historically recognized for its wealth and the ingenuity of its people, and by situating the narrative within this context, Clason taps into the allure and mystique of the ancient city. The setting exemplifies the universal relevance of economic wisdom, suggesting that the guidance provided transcends time and geography. Aspects of Babylonian life, such as the city's famous walls and the lavishness of the Hanging Gardens, are woven throughout the narrative, underscoring the success of its citizens in creating prosperity. This context amplifies the legitimacy of the financial lessons, suggesting that if such wealth can be achieved in ancient Babylon, it can be achieved anywhere.

Unique Aspects

One of the most distinguishing aspects of “The Richest Man in Babylon” is its use of historical settings and parables to convey modern financial concepts. Clason's book stands out for turning what could have been a dry, technical subject into a series of engaging stories that resonate on a personal level with readers. Additionally, the book's systematic presentation of wealth-building strategies serves as a precursor to many self-help and personal finance books that would follow, making it a pioneering work in the genre. Its constant emphasis on discipline, financial planning, prudent investing, and the wisdom of seeking counsel from more knowledgeable parties reflects a holistic approach to wealth management, which can be particularly appealing to those overwhelmed by modern-day financial complexities. Thus, the timeless nature of its advice and the narrative format in which it is delivered contribute to its lasting legacy and continued relevance.

Similar to The Richest Man in Babylon

Sure, below is an example of how you can use HTML table tags along with inline CSS styles to display a thorough analysis of the pros and cons of “The Richest Man in Babylon”:

“`html

| Pros | Cons |

|---|---|

|

|

|

User Experience Impact: Readers feel empowered and gain fundamental financial wisdom that's applicable to personal finance management. |

User Experience Impact: Users may find it difficult to apply the teachings directly without additional contemporary financial education. |