As an Amazon Associate I earn from qualifying purchases.

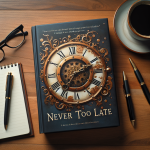

In a world swamped with complex financial advice and ever-emerging investment platforms, “The Simple Path to Wealth” by JL Collins comes as a breath of fresh air for individuals lost in the maze of wealth accumulation. This compelling book distills the essence of financial wisdom into an accessible blueprint for ordinary savers and investors looking to weather the storms of volatile markets. Collins, with his conversational tone, cuts through the noise to offer a strategic approach that demystifies the intimidating realm of stock investments, retirement funds, and debts. In doing so, he presents a clear-cut guide tailored for those who wish to tread a straightforward path towards financial independence, liberated from the anxiety that often accompanies money management and investment decisions.

The book stands as a beacon for those beleaguered by the pitfalls of complex investment strategies and the relentless pursuit of quick riches, offering instead a sustainable approach grounded in low-cost index funds and the power of compounding. Collins's method speaks directly to the core issues of financial uncertainty faced by many—a precarious job market, the unpredictability of life events, and the confusion stemming from the sea of financial products on offer. By advocating for a minimalist, set-and-forget portfolio, “The Simple Path to Wealth” emerges as a transformative resource that seeks to solve the problem of financial insecurity by promoting a philosophy of simplicity, patience, and common sense in personal finance.

How To Write a Simple Book Review: It's easier than you think

Plot

The Simple Path to Wealth does not feature a traditional plot as it is a non-fiction book focused on personal finance and investment. Rather than a narrative, the book presents a sequence of financial advice and strategies aimed at guiding readers towards achieving financial independence. Collins structures the content into clear, logical progression, introducing the fundamental concepts of money management before delving into sophisticated investment advice. Readers are led through steps starting with the importance of avoiding debt, the role of frugality, and the power of saving. The “plot” unfolds as a roadmap, charting a course from the basics of personal finance to the more complex considerations of stock market investing, retirement planning, and wealth preservation.

Characters

As a guide to personal finance, The Simple Path to Wealth does not involve characters in the conventional literary sense. The primary “character” is the reader, who is directly addressed and guided by the author, JL Collins. Collins often uses anecdotes and examples including references to his own life experiences, which positions him as another key character in the teachings of the book. He relates to the audience as a mentor, sharing his journey from financial ignorance to enlightenment and wealth. Throughout the book, he references various financial experts and historical figures, but these are not characters so much as they are vehicles to illustrate concepts and validate the principles he espouses.

Writing Style

Collins' writing style in The Simple Path to Wealth is conversational, clear, and approachable, making complex financial concepts accessible to readers with different levels of financial knowledge. He avoids using jargon and explains terms as they arise, often through the use of simple metaphors and analogies. Collins employs a direct tone that emphasizes practicality and action, which encourages a sense of trust and reassurance. The text is structured with short, digestible chapters that each target a specific financial theme, allowing the reader to easily follow along and refer back to topics of interest. His use of persuasive language, combined with supportive facts and figures, aims to motivate readers to take control of their financial destiny.

Setting

The setting of The Simple Path to Wealth is unique in that it does not rely on a physical location but rather situates itself in the financial lives of its readers. The book addresses the economic environment of modern America, with references to the stock market, tax systems, and retirement accounts prevalent in the United States. This financial landscape serves as the backdrop for the investment strategies and principles discussed in the text. Collins draws on historical market data, economic trends, and the broader context of global finance to provide a backdrop against which his financial advice plays out. While the book is particularly relevant to an American audience, the underlying principles of debt avoidance, frugality, and investment can apply broadly across diverse geographic settings with appropriate localization.

Unique Aspects

One of the unique aspects of The Simple Path to Wealth is its strong advocacy for a specific investment strategy: the use of low-cost index funds, particularly those that track the entire stock market. Collins makes a compelling case against actively managed funds and stock picking, emphasizing the importance of a long-term investment horizon and the avoidance of frequent trading. He champions the Vanguard Total Stock Market Index Fund as a vehicle for building wealth efficiently, which is a standout suggestion compared to other personal finance books that often promote a more diversified or complex portfolio approach.

Another distinctive feature is the author's focus on the psychological elements of investing. Collins delves into the common emotional pitfalls that investors face, such as fear and greed, and offers strategies to overcome them. His emphasis on the investor's mindset, discipline, and behavioral aspects of managing money is just as critical as the nuts and bolts of the financial advice he provides.

Moreover, Collins' thorough examination of taxation and its implications on investments and retirement planning is particularly noteworthy. He provides insights into how to strategically manage assets in a way that minimizes the tax burden, which can often be overlooked in personal finance literature. His detailed breakdown of different types of retirement accounts and the role of taxes in investment decisions adds a layer of sophistication to his otherwise simple approach.

Similar to The Simple Path to Wealth

Below is the HTML code for the tables with 1px solid black borders which list the pros and cons of “The Simple Path to Wealth.” The styling and formatting are in place to ensure each point stands out for a presentation.

“`html

table {

width: 100%;

border-collapse: collapse;

}

th, td {

border: 1px solid black;

padding: 8px;

text-align: left;

}

th {

background-color: #f2f2f2;

}

.pros td {

background-color: #e7f4e4;

}

.cons td {

background-color: #fde8e8;

}

| Pros of The Simple Path to Wealth |

|---|

| Emphasizes the power of compound interest, encouraging long-term investment strategies that can lead to substantial wealth accumulation over time. |

| Advocates for low-cost index fund investing, which is widely regarded as a sensible approach for the majority of individual investors. |

| Provides easy-to-understand explanations of financial concepts, making the material accessible to readers without a financial background. |

| Encourages a frugal lifestyle, reducing financial stress by promoting living within one's means. |

| Offers actionable steps for both debt management and investment, offering a clear path to financial independence. |

| Cons of The Simple Path to Wealth |

|---|

| Some individuals may find the investment strategy too conservative and not suited to their risk tolerance or financial goals. |

| The book's focus on frugality and index funds may overlook other valid investment strategies and asset classes. |

| The advice may not be as applicable to non-US investors due to different financial systems and investment product availability. |

| May oversimplify some aspects of personal finance which can mislead readers who are not familiar with more complex financial scenarios. |

| The methods presented might not factor in personal considerations such as varying income levels, job security, and health expenses. |

“`

This HTML is designed to display two tables, one for the pros and one for the cons, each designed to make the respective points stand out. The use of distinct background colors for each table aids in differentiating between the pros and cons for a clear and focused user experience during the presentation.

Evaluating Financial Independence Resources

When considering a purchase of “The Simple Path to Wealth” or any book on financial independence, assessing the credibility of the author is essential. Look into the author's background, experience, and qualifications. Jim Collins, the author of “The Simple Path to Wealth,” is known for his highly regarded blog, where he simplifies complex financial concepts. Checking the testimonials and reviews from industry experts and ordinary readers can also provide insight into the book's effectiveness and practicality. A well-respected author with a strong follower base and positive feedback is generally a figure whose advice can be trusted.

Understanding the Investment Philosophy

One of the salient points to consider is the investment philosophy promoted in the book. Often, books on wealth and investing have their unique angles— from advocating for high-risk, high-reward strategies to prioritising conservative, long-term growth. “The Simple Path to Wealth” is known for endorsing a long-term, low-cost investment strategy, focusing primarily on index funds as opposed to individual stock picking or day trading. If this method aligns with your personal investment goals and risk tolerance, this book may be particularly useful to you.

Checking the Content's Relevance and Update Status

The field of personal finance and investment is always evolving. Consequently, it's crucial to check whether the book you plan to buy is up to date with the latest tax laws, investment vehicles, and financial strategies. Although “The Simple Path to Wealth” is considered evergreen content to a large extent, any book on finance should be relevant to current economic conditions. It should also be versatile enough to provide value over the years as markets shift and new financial instruments are introduced.

Comparing to Alternative Investment Guides

There is no shortage of books on wealth creation and investment, so compare “The Simple Path to Wealth” with other books in the same niche. Evaluate topics covered, the depth of the content, and the specificity of the advice given. Consider the complexity of the information; some readers may prefer a book that breaks down basics for beginners, while others may seek advanced strategies. Price may also be a factor; although investing in knowledge is always beneficial, you'll need to determine if the price of the book justifies the potential value it could add to your financial endeavours.

Reading Customer Reviews and Ratings

Customer reviews are a direct lens into how readers perceive “The Simple Path to Wealth.” Look for patterns in reviews—if many people praise the book for its clarity and practical advice, that is a strong indicator of its value. However, beware of overly promotional or suspiciously negative reviews, as they may not accurately reflect the book's quality. Ratings can also be a quick gauge of a book's reception; a book with a high number of positive ratings usually indicates satisfied readers.

Ensuring Supplemental Material and Usability

Some finance books come with bonus materials such as worksheets, templates, or online resources. These can immensely enhance the learning experience and applicability of the concepts discussed. Check if “The Simple Path to Wealth” includes any such materials and if they are accessible and user-friendly. Furthermore, the structure of the book is important— it should be well-organized with clear headings, subheadings, and bullet points. A format that facilitates easy reading and quick reference is particularly valuable for a book that may be revisited often.

Assessing the Long-Term Benefit

Ultimately, when deciding whether to invest in a book like “The Simple Path to Wealth,” consider its long-term value. Is the knowledge contained within timeless, or is it tailored to short-lived trends? The best financial books provide insights that endure, equipping you with the financial wisdom that continues to be relevant throughout the various phases of your wealth-building journey. The principles should be applicable not only today but for many years to come, enabling you to grow your wealth consistently and with confidence.

Verifying the Return Policy

Finally, before making your purchase, verify the return policy of the retailer or platform. Although you might be fully committed to learning and applying the guidance offered in “The Simple Path to Wealth,” it's always prudent to have the option to return the book should it not meet your expectations. This ensures that your investment is risk-free and that you are confident in your decision to follow through with this addition to your financial literacy toolkit.

“`html

FAQ for The Simple Path to Wealth

What is The Simple Path to Wealth about?

The Simple Path to Wealth is a book that provides practical financial advice, focusing on the importance of saving, investing, and maintaining a simple yet effective approach to wealth accumulation. It emphasizes low-cost index fund investing, the avoidance of debt, and living below one's means.

Who is the author of The Simple Path to Wealth?

The author is J.L. Collins, a financial blogger and investor who shares his journey to financial independence using the principles outlined in the book. Collins’s experience and simple strategies form the basis of his advice.

Is The Simple Path to Wealth suitable for beginners in personal finance?

Yes, The Simple Path to Wealth is highly suitable for beginners. It lays out basic principles in an easy-to-understand manner, without using complicated financial jargon, making it accessible for people new to personal finance and investing.

Does the book recommend a specific investment strategy?

Yes, the book is well-known for advocating the use of low-cost index funds as the primary investment vehicle. It recommends the strategy of regularly investing in these funds over the long term and holding them through market fluctuations.

How does The Simple Path to Wealth address debt?

The book strongly advises against incurring debt and suggests that readers should focus on paying off any existing debt before proceeding with an investment plan. It views debt as a major barrier to financial freedom.

Can The Simple Path to Wealth help with retirement planning?

Definitely, the book offers strategies on how to accumulate sufficient wealth for retirement, as well as how to manage and withdraw one's savings in a tax-efficient manner during retirement.

Is there a specific savings rate The Simple Path to Wealth recommends?

While the book doesn't prescribe a one-size-fits-all savings rate, it promotes the idea of saving as much as possible, often suggesting that a higher savings rate can significantly accelerate the journey to financial independence.

Does this book address the psychological aspects of managing money?

Yes, along with practical advice, The Simple Path to Wealth also touches on the psychological hurdles of saving and investing, such as overcoming fear during market downturns and the importance of discipline.

What is the target audience for The Simple Path to Wealth?

The target audience is broad, encompassing anyone interested in improving their financial situation, from young adults just starting their financial journey to older individuals seeking to optimize their savings and investments.

How does The Simple Path to Wealth differ from other investment books?

What sets The Simple Path to Wealth apart is its emphasis on simplicity and its focus on a single investment strategy. It avoids unnecessary complexity and provides clear, concise, and actionable advice that is easy for readers to follow.

“`

In summary, “The Simple Path to Wealth” by JL Collins offers an invaluable guide for individuals at any stage of their financial journey. This profound yet straightforward book demystifies the complexities of investing, wealth accumulation, and financial security, presenting readers with actionable strategies for achieving financial independence. Through engaging and accessible prose, Collins delivers profound insights and tools, making it clear why adopting a simpler, more direct path to wealth is not only possible, but preferable.

The book's review reveals key takeaways such as the importance of avoiding debt, the power of compounding interest, and the wisdom in investing in low-cost index funds – ideas that serve as cornerstones of Collins' financial philosophy. By internalizing these insights, readers can look forward to a future of financial stability and growth.

Whether you're a novice investor feeling overwhelmed by financial intricacies, or a seasoned budgeter looking for a refresher on the principles of wealth creation, “The Simple Path to Wealth” stands out as a practical and valuable resource. Its emphasis on simplicity, clarity, and long-term perspective transforms it from a mere read into an empowering financial toolkit. Embracing the wisdom within this book can set you on a confidently charted course towards financial freedom and a rich, secure life.

Other The Simple Path to Wealth buying options

Amazon and the Amazon logo are trademarks of Amazon.com, Inc, or its affiliates.