As an Amazon Associate I earn from qualifying purchases.

In an era where the relentless pursuit of financial success often eclipses the quest for personal fulfillment, “Your Money or Your Life” by Vicki Robin emerges as a beacon of hope for those ensnared in the rat race. The book presents a transformational philosophy that challenges readers to redefine their relationship with money, urging them to assess not just their finances, but their very conception of prosperity. Coined as a potent antidote to modern consumerism, Robin's work is not just a guide to managing finances but is often hailed as a life-changing tour de force that has reshaped the way people think about work, wealth, and personal happiness.

Addressing one of the most pressing dilemmas of contemporary life—the silent trade-off between time and money—”Your Money or Your Life” offers practical solutions that promise liberation from debt, the nine-to-five grind, and the insatiable desire for more. No longer must readers accept the default script of spending a majority of their waking hours in jobs they tolerate to buy things they don't need. Through a series of nine deliberate and systematic steps, Vicki Robin provides the tools to break free from financial entrapment. Her philosophy tackles the core problem that plagues modern society: a mismatch between our spending habits and our most deeply held values. It's a book that doesn't just aim to rearrange one's financial landscape, but also to realign personal goals with what one truly considers a life worth living.

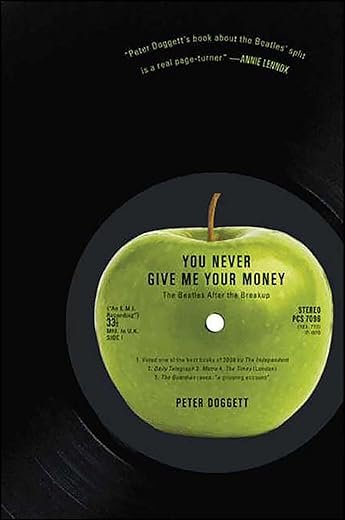

You Never Give Me Your Money: The Beatles After the Breakup

Plot

The core plot of “Your Money or Your Life” doesn’t follow a traditional narrative structure with characters and events, but rather unfolds as a financial program. This program is designed to transform the reader's relationship with money and work, guiding them through a series of nine steps to achieve financial independence and a more mindful and meaningful life. The plot, in essence, is the reader's journey through these steps – from assessing their financial situation to changing their spending habits, and finally to achieving financial freedom. Each step builds upon the previous one, presenting a structured path towards personal finance mastery. Throughout the book, readers are encouraged to track their income, expenses, and life energy spent on work in order to align their spending with their values.

Characters

While “Your Money or Your Life” does not have characters in the traditional literary sense, the authors, Vicki Robin and Joe Dominguez, serve as mentors guiding the reader through the text. They share their own experiences and those of individuals who have successfully implemented the program, effectively acting as characters whose stories and insights add depth to the financial principles discussed. These anecdotal characters offer varied perspectives on financial independence, providing real-life context that helps readers relate the book’s concepts to their own lives. Additionally, the reader, while engaging with the book, can be viewed as the protagonist who is taking action to reshape their financial future.

Writing Style

The writing style of “Your Money or Your Life” is direct, conversational, and instructional, mirroring the style of a self-help guide. It employs clear language and practical examples to demystify complex financial concepts and make them accessible to a broad readership. This pragmatic approach is interspersed with motivational passages that encourage readers to persist with the program. The book often addresses readers directly, creating an interactive and engaging reading experience. Its systematic use of charts, bullet points, and step-by-step instructions facilitates comprehension and application of the material. Robin's compassionate tone resonates throughout the text, which helps to reassure readers as they confront often challenging truths about their financial habits and life choices.

Setting

In “Your Money or Your Life,” the setting is not a physical space but rather the personal financial landscape of the reader's life. It exists in the abstract realm of personal finance, consumer habits, and the workplace. The book takes readers through various settings, such as the home, where they explore their daily spending, and the workplace, where they evaluate the relationship between their life energy and their job. The economic environment that envelopes the readers’ lives also serves as a backdrop, providing the context for discussions about societal views on money, work, and consumption. The book encourages readers to scrutinize these environments and make conscious choices that reflect their true values and aspirations.

Unique Aspects

One of the unique aspects of “Your Money or Your Life” is its holistic approach to personal finance, which goes beyond mere budgeting or money management. It introduces the concept of “life energy” and invites readers to consider not just the financial cost of their purchases, but also the amount of life energy expended to obtain that money. This transforms the act of spending into a more profound assessment of value and purpose. The book also stands out for its focus on achieving financial independence and the notion that this is attainable for individuals at any income level. Furthermore, it delves into the psychological and spiritual dimensions of money, prompting readers to explore their beliefs and attitudes towards wealth and work. The book has been effective in initiating a cultural conversation about sustainable living and responsible consumption, influencing the minimalist movement and laying the groundwork for the modern Financial Independence, Retire Early (FIRE) movement.

Similar to Your Money or Your Life

Below is an example of how you could format the analysis of the pros and cons of “Your Money or Your Life” with HTML, using tables with solid 1px black borders:

“`html

table {

width: 100%;

border-collapse: collapse;

}

th, td {

border: 1px solid black;

padding: 8px;

text-align: left;

}

th {

background-color: #f2f2f2;

}

.pros {

color: green;

}

.cons {

color: red;

}

Pros of Your Money or Your Life

| Advantage | Impact on User Experience |

|---|---|

| Financial Independence | Encourages users to save and invest, leading to financial freedom and less stress related to money matters. |

| Greater Awareness | Helps users become more conscious about their spending, fostering a sense of empowerment over financial choices. |

| Life Alignment | Guides users to align their financial goals with their personal values, increasing life satisfaction. |

Cons of Your Money or Your Life

| Disadvantage | Impact on User Experience |

|---|---|

| Time Commitment | The process can be time-consuming, potentially overwhelming users who have limited time to allocate to financial planning. |

| Complex Concepts | Some users may find the principles and techniques challenging to grasp, which can lead to frustration or disengagement. |

| Lifestyle Changes | Adopting the program's suggestions might require significant lifestyle changes that some users may find restrictive or difficult to sustain. |

“`

In this HTML example, each pro and con of “Your Money or Your Life” is presented in a separate table row, making it clear and organized. The impact on the user experience is also explained directly for each point. The pros are labeled in green and the cons in red for a visual distinction. Please note that this example is a template and the actual contents (advantages/disadvantages and impacts) should be written based on a thorough analysis of “Your Money or Your Life.”

Evaluating Personal Finance Books

When you're seeking guidance on managing your financial life, the book “Your Money or Your Life” by Vicki Robin and Joe Dominguez stands out as a seminal work in personal finance. However, before committing to a purchase, consider the book's relevance to your current financial situation. Examine the core focus of the book, which integrates personal finance with life goals and happiness, a concept not typically underscored in more traditional finance books.

Additionally, assess the book's approach to financial independence and frugality. Unlike some investment-centric books that emphasize wealth generation through stocks or real estate, “Your Money or Your Life” offers a systematic approach to transforming your relationship with money. Ensure the philosophy of living modestly aligns with your financial goals and lifestyle aspirations.

Understanding the Author's Expertise and Background

The credibility of the authors plays a pivotal role in the book’s practicality. Vicki Robin’s experience with financial management education and Joe Dominguez's background as a successful financial analyst provide a foundation of both academic and practical financial wisdom. Consider if the author’s expertise resonates with you and if their teachings are grounded in experiences that reflect your financial values.

Comparing Formats and Editions

“Your Money or Your Life” is available in multiple formats—hardcover, paperback, e-book, and audiobook. When choosing the right format, contemplate your reading habits. If you favor physical notes and highlights, a print version may be best. If you're often on the go, an audiobook or e-book might be more convenient. Additionally, check if you're opting for the updated edition, as it includes modern references that align with today’s economic environment and technological advancements.

Checking Reader Reviews and Ratings

Investigate what other readers have to say. Reviews and ratings can be valuable indicators of the book's impact and usefulness. Look beyond the overall star rating and read through the comments to gauge whether readers with financial circumstances similar to yours found the book beneficial. Be mindful, though, of overly positive or negative reviews, and seek a balanced perspective to understand both the strengths and potential shortcomings of the book.

Analyzing the Book’s Cohesion with Financial Goals

The principles outlined in “Your Money or Your Life” emphasize minimalist living and the connection between time, money, and happiness. If your goal is to acquire quick investment strategies or detailed advice on tax loopholes, this book may not align well with those immediate objectives. This guide is more suited for those seeking a transformative financial lifestyle shift that centers on mindfulness and strategic life planning.

Considering Supplemental Materials and Resources

The book often references tools and resources such as worksheets and expense tracking methods. Explore whether these supplemental materials are accessible and user-friendly. Some editions may offer updated resources or online tools that can provide added value to your purchase. Additionally, consider whether the book references additional reading or suggests a community of practitioners for ongoing support, which can be invaluable in applying the book's principles.

Reflecting on Your Long-Term Financial Philosophy

Reflect on how the book’s ethos compares to your long-term financial philosophy. It’s essential to contemplate whether your values align with the principles of “Your Money or Your Life,” as the process it suggests is not merely about money—it’s a holistic journey towards achieving a purposeful and financially independent life. This book will have the most significant impact on those who are ready to commit to a long-term process of financial self-reflection and change.

In choosing “Your Money or Your Life,” consider the investment not just in a book, but in a potential catalyst for profound change in your financial and personal life. Evaluate its alignment with your values and goals, and the practicality of its content to your unique situation. With these considerations in mind, you are better positioned to decide if this book is the right financial companion for you.

“`html

FAQ – Your Money or Your Life

What is “Your Money or Your Life” about?

Your Money or Your Life” is a book that provides a framework for transforming your relationship with money and achieving financial independence. It offers a nine-step program that helps individuals to live more deliberately and meaningfully with their finances.

Who wrote “Your Money or Your Life”?

The book was authored by Vicki Robin and Joe Dominguez, with a foreword by Mr. Money Mustache (Pete Adeney in later editions). Vicki Robin is a renowned speaker and writer on financial independence and sustainable living, while Joe Dominguez was a successful financial analyst who retired at the age of 31.

Can “Your Money or Your Life” help me get out of debt?

Yes, “Your Money or Your Some people” have successfully used the principles in “Your Money or Your Life” to reduce and eliminate their debt. The program focuses on changing your spending habits, saving money, and investing in assets that generate passive income, which can all contribute to paying down debt.

Is the book's approach suitable for all income levels?

The basic principles of “Your Money or Your Life” can be applied by individuals at any income level. It focuses on mindful spending, saving, and investing, which can be tailored to one's personal financial situation regardless of income.

Do I need to have a financial background to understand the book?

No, the book is written for a general audience and is accessible without a financial background. It provides clear explanations of financial concepts and actionable steps that can be understood by anyone who is interested in improving their financial health.

How much time does it typically take to see results from following the program in “Your Money or Your Life”?

Results will vary based on individual circumstances, such as income level, debts, and expenses. Some readers may see immediate changes in their financial habits, while others may take months or even years to fully implement the program and see significant financial changes. Consistency and commitment to the program's principles are key to seeing results.

Does the program promote a particular investment strategy?

While “Your Money or Your Life” does discuss the importance of making your money work for you, it does not prescribe a one-size-fits-all investment strategy. Instead, it encourages readers to educate themselves on various investment options and to choose those that align with their personal goals and risk tolerance.

How can I track my progress while following the program?

The book suggests tracking your progress by keeping detailed records of your income, expenses, and savings, and by regularly reviewing your financial goals. It also recommends calculating your “real hourly wage” and your “crossover point” to help evaluate the cost of your lifestyle versus your passive income.

Is there a community or support group for individuals using the “Your Money or Your Life” program?

Yes, there is an active community of individuals who follow the principles of “Your Money or Your Life. Online forums, social media groups, and local meetups can provide support and encouragement from others who are on the same financial journey.

Have there been any updates or revisions to “Your Money or Your Life” since its original publication?

The book has undergone several updates and revisions to reflect modern financial realities and to include up-to-date resources. For example, the more recent editions include considerations for the digital age and the modern economic environment.

“`

In summary, “Your Money or Your Life” by Vicki Robin offers a transformative approach to personal finance that extends beyond mere money management; it provides readers with the tools to achieve financial independence while promoting a life of purpose and fulfillment. Robin's book is more than just a guide to saving money — it's a roadmap to redefining our relationship with work and wealth.

Throughout the review, it's become clear that this book is essential for anyone looking to take control of their fiscal destiny and live a more intentional, values-driven life. With its actionable steps and profound insights, “Your Money or Your Life” equips you to not only manage your finances more effectively but also to align your spending with your deepest values — a strategy that promises to enrich your life as much as your bank account.

As we've delved into the tenets of Robin's philosophy, from the importance of understanding your true hourly wage to the practice of converting your expenses into life energy, each concept has shown its potential to revolutionize the way we perceive and interact with money. The book's focus on sustainability and conscious consumption is timely and resonates profoundly in our current age of environmental awareness and personal empowerment.

Whether you're struggling with debt, seeking to retire early, or simply wishing to live more mindfully, “Your Money or Your Life” is not just a valuable choice—it's a cornerstone work that should have its place on any financially conscious reader's shelf. With countless readers attributing their financial success and happiness to the wisdom contained within its pages, this book stands as a testament to the idea that financial health and personal well-being are inextricably linked.

Experience the life-changing benefits for yourself and discover how Vicki Robin's “Your Money or Your Life” could be the most important investment you'll ever make — for your wallet, your happiness, and your future.

Other Your Money or Your Life buying options

Amazon and the Amazon logo are trademarks of Amazon.com, Inc, or its affiliates.